Classification1

New token definitions

FINMA's current practice distinguishes between three categories of tokens (although a single token may meet the criteria of several categories simultaneously):2

- Payment tokens: The category "payment tokens" (also "cryptocurrencies") includes tokens that are accepted or intended by the issuer to be accepted, as a means of payment for the purchase of goods or services, or that are intended to serve as a means of transferring money and value. Cryptocurrencies do not confer any claims against an issuer.

- Utility tokens: FINMA defines "utility tokens" as tokens intended to provide access to a digital application or service that is offered on or via a blockchain infrastructure.

- Investment tokens: The category of "investment tokens" includes tokens that represent assets and, as such, constitute either a contractual claim against the issuer or a membership right within the meaning of company law.

While the current definition of investment and utility tokens remains unchanged, the proposed legislation introduces new legal definitions for "value-stable crypto-based means of payment" on the one hand and "crypto-based assets with trading characteristics" on the other, which currently fall under the category of payment tokens or, more specifically, "stablecoins".

"Value-stable crypto-based means of payment" refer to stablecoins that:

- are issued in Switzerland

- are pegged to a single government-issued fiat currency,

- are required to maintain a stable value, and

- oblige the issuer to repay the holder at the predetermined value of the stablecoin.

Stablecoins that do not meet these cumulative requirements will generally qualify as collective investment schemes, financial instruments or, similarly, as the newly defined category "crypto-based assets with trading characteristics". The legislator has provided a negative definition for the latter. These are crypto-based assets that:

- are not issued by a central bank nor by a state,

- do not grant their holder an exclusive right to access a use or service (i.e. are not utility tokens),

- are neither financial instruments nor value-stable crypto-based means of payment,

- do not constitute deposits under banking law.

Crypto-based assets of a commercial nature will notably include cryptocurrencies (Bitcoin, Ether, etc.) and stablecoins that are not issued in Switzerland but otherwise meet the requirements of a value-stable crypto-based means of payment.

New FinIA licence category: payment institutions

The licence for payment institutions is intended to further develop, and ultimately replace, the fintech licence introduced under the Banking Act in 2018. The business activities defined in Art. 1b of the Banking Act closely resemble those set out in the new Art. 51a FinIA and continue to include, in particular, the acceptance of funds without a banking licence, subject to a prohibition on interest payments and significant restrictions on investment opportunities.

Former fintech institutions transitioning from being subject to the Banking Act to the FinIA will largely be able to build on existing requirements, particularly in the areas of risk management and compliance, governance and capital adequacy. Accordingly, fintech institutions are to be automatically granted the new payment institution within the meaning of the FinIA, provided they meet the new or regulatory requirements.

The most important features and/or amendments of the new regulatory framework include:

- New definition of customer funds, which is being introduced specifically for the activities of payment institutions. This is intended to simplify the distinction between payment institutions and banks (which accept public deposits) as well as the corresponding differences in regulatory treatment (e.g. deposit insureance for public deposits).

- Obligation to segregate customer funds, which means that in the event of insolvency, these funds do not fall into the institution's bankruptcy estate.

- Prohibition on paying interest and restrictions on investing customer funds.

- Exclusivity for the issuance of value-stable crypto-based means of payment: this activity is reserved for payment institutions. Since the licence as a payment institution is exempt from FinIA’s licensing cascade, even institutions in a higher licensing categories (e.g. banks) would need to establish a separate legal entity with the appropriate licence in order to engage inthis activity.

- Elimination of the CHF 100 million threshold in Art. 1b of the Banking Act, meaning that there is no longer a threshold above which a different licence category is required.

- Disclosure requirements regarding the terms and conditions of the token, reserves and material risks.

- Subjection to the Anti-Money Laundering Act (AMLA): As previously under the Banking Act, payment institutions must also comply with the provisions of the AMLA.

- Subjection to the FinSA: Issuing payment institutions would in principle be subject to the FinSA. Further details can be found in the chapter "Impact on market participants".

New FinIA category: crypto institutions

The business activities of crypto institutions comprise a range of crypto-based services, in particular:

- Custody of both value-stable crypto-based means of payment and crypto-based assets with trading characteristics (account management)

- Trading in crypto-based assets with a trading characteristic, conducted in the institution’s own name on behalf of clients

- Short-term proprietary trading in crypto-based assets of a trading characteristics, with public or request-based quoting of prices for individual assets

- Staking3

- Operation of a trading system/exchange services

The licence for crypto institutions is modelled on the existing licensing requirements for securities firms, such as accounting, minimum capital, governance and risk management. However, at the ordinance level, the requirements are to be tailored specifically to crypto-assets and proportionately reduced in scope.

The most important features and/or amendments of the new regulatory framework are, in particular:

- Prohibition of uncovered proprietary trading

- Prohibition of lending activities

- Obligation to segregate crypto-based means of payment/assets held in custody

- Subjection to the AMLA: Crypto institutions will be fully subject to the AMLA and must implement appropriate measures. Although this does not constitute a fundamental change for many companies already operating in the exchange/payment services sector, institutions currently affiliated with an SRO would now be directly subject to and supervised by FINMA.

- Subjection to the FinSA: Certain already known provisions of the FinSA relating to customer protection may apply in whole or in part, depending on the specific nature of the business activity. Further details can be found in the chapter "Impact on market participants".

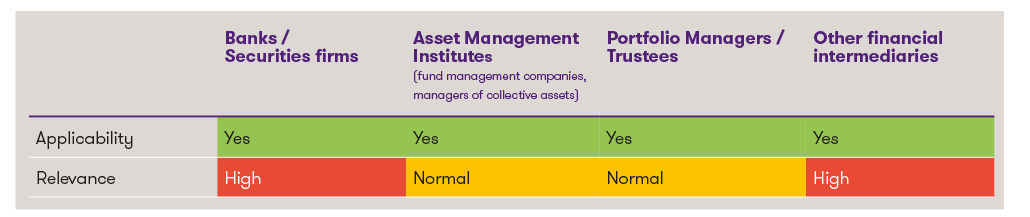

Impact on market participants

Uniform transition periods are proposed for the two new licence categories. Previously unregulated providers (e.g. brokers or stablecoin issuers) will have twelve months to submit a licence application. Fintech institutions that are already supervised do not need to apply for a new licence but must ensure compliance with the new regulatory requirements within one year of the new provisions coming into force. With regard to the new licensing category of payment institution, institutions with an existing banking licence will be required to apply for a licence in order to be able to operate as a payment institution – in particular, banks will be obliged to establish a separate legal entity for this purpose.

The introduction of the new licensing categories will therefore lead to significant changes for market participants. A large number of financial intermediaries that are currently subject to SRO supervision would in future be supervised directly by FINMA. Direct prudential supervision by FINMA implies a higher level of supervisory intensity. Both providers that will newly fall within the scope of regulation and institutions already subject to FINMA should begin aligning their processes and organisational structures with the upcoming regulations in order to ensure full compliance with the new rules.

Under the revised FinIA, (issuing) payment institutions and crypto institutions will explicitly be classified as financial institutions (Art. 2 para. 1 lit. f and g Draft-FinIA). Depending on the type of institution and the specific services offered, the new licensing categories will also have varying implications for the applicability of FinSA provisions.

When assessing the amendments to FinSA and the applicability of FinSA to the new payment institutions and crypto institutions, two points should be considered for the time being:

- Both crypto-based assets with trading characteristics and value-stable crypto-based assets will continue to be excluded from the definition of financial instruments within the meaning of FinSA.

- Accordingly, the activities of crypto institutions and payment institutions will still not constitute financial services, nor will the corresponding institutions qualify as financial service providers within the meaning of FinSA.

A specific chapter is being introduced to ensure adequate customer protection for the provision of services involving crypto-based assets of a trading nature. The following FinSA provisions are declared applicable in this chapter:

- Provisions on suitability and appropriateness (Art. 11–14 FinSA)

- Transparency and due diligence in handling customer orders (Art. 17-19 FINMASA)

- Provisions on organisation (Art. 21–27 FINMASA), including the respective implementing provisions at ordinance level. These include, in particular, the requirements for dealing with conflicts of interest (see Art. 25–27 FINMASA and Art. 24–30 FINMASA).

- Compliance with the duty to provide information in accordance with Art. 8 and 9 FinIA (partial exceptions for professional and institutional clients (Art. 71a-c Draft-FINIG).

In addition, disclosure and information requirements in the form of the publication of a white paper, which is based on the familiar prospectus requirements, are envisaged for the issuance of stable crypto-based assets and for the offering of crypto-based assets with a trading characteristic. The FinSA draft also contains provisions governing advertising for value-stable crypto-based assets and crypto-based assets with trading characteristics.

Conclusion

The consultation procedure closed on 6 February 2026. Once the submissions have been reviewd, the message will be submitted to parliament for deliberation. From today's perspective, the new provisions are not expected to enter into force before 2027. The introduction of the two new licensing categories will support harmonisation with international developments and establish a risk-based regulatory framework tailored for the respective institutions.

Fintech institutions and/or financial intermediaries that are already active in the crypto sector or use crypto assets in the course of their business activities (including asset managers) should closely monitor the legislative process and familiarise themselves early on with their options and potential implications.

From a financial market policy perspective, the proposed direct subordination of institutions previously regulated by SROs to FINMA supervision is particularly noteworthy. This may be interpreted as a deliberate shift by the Federal Council away from the supervisory organisations (SOs) model towards a more centralized approach, whereby all financial institutions, regardless of their size, are subject to direct, ongoing supervision by FINMA.

If you have any questions regarding the introduction of the two new licensing categories or other financial market law matters, the Regulatory & Compliance team will be happy to assist you. We look forward to hearing from you.

1This is a highly simplified presentation intended to enable a quick initial assessment of the topic. Each institution should determine the relevance and specific need for action on an individual basis.

2FINMA guidelines for enquiries regarding regulatory classification of initial coin offerings (ICOs) dated 16 February 2018.

3In simple terms, staking involves temporarily blocking crypto assets on a validator address. By doing so, staking participants contribute to the proof-of-stake process and receive rewards (usually newly issued tokens) in return.