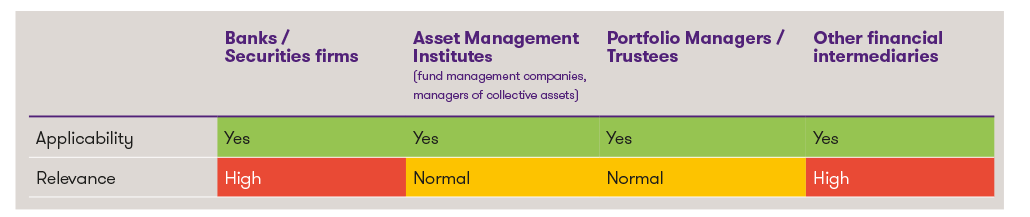

Classification1

Planned changes

The revision contains a few clarifications and four key changes, most of which are additions and simplifications, but some of which are also a tightening of the rules:

-

Approval of Swiss e-ID for online identification

In the future, online identification using Swiss e-ID will be possible2. When identifying online via e-ID in accordance with the e-ID Act, the financial intermediary must check whether the e-ID is valid and has been issued to the contracting party. This corresponds to opening an account by correspondence, which is why an additional check of the residential address is required. - Extension to ID cards with QR codes for video and online identification

In addition to documents with a machine-readable zone (MRZ)3, official ID cards with QR codes will now also be accepted for video and online identification. This takes national and international developments into account. For example, the new Swiss driver's license with a QR code instead of an MRZ, which has been in use since April 2023, will now be included in the circular. - Check of the residential adress for QES (simplified online identification)

During the identification with an electronic ID card and the authentication using a qualified electronic signature (QES), in addition to checking the information on the ID card against that of the qualified electronic signature, it will now also be necessary to check the residential address. This takes into account a change from 2022, according to which a QES can also be obtained without a personal visit. - Online identification for legal entities

It will now also be possible to identify individuals who are onboarding on behalf of the legal entity/partnership by means of online identification. Previously, this was only permitted via video identification.

Conclusion

Once the consultation period ends in February 2026, FINMA will evaluate the comments received and publish a report setting out which points will be implemented. The partial revision of the FINMA circular is expected to come into force at the same time as the ordinance on the E-ID Act. Financial service providers with electronic customer onboarding should carefully analyze the opportunities offered by the new possibilities, but also the impact of the tightening of regulations on existing processes and adapt their processes accordingly if necessary.

1 This is a highly simplified overview intended to provide a quick initial introduction to the topic. Each institution should determine the relevance and specific need for action on an individual basis.

2 For further information on e-ID, please refer to https://www.eid.admin.ch/en.

3 Visible part of an ID document that can be read by optical character recognition.