Classification 1

1 This is a highly simplified presentation intended to enable a quick initial categorisation of the topic. Each institution should determine the relevance and the specific need for action individually and specifically.

Background

The events surrounding Credit Suisse have revealed that the current too-big-to-fail (TBTF) regime is not sufficient in certain situations to guarantee the personal responsibility of large banks or to enable orderly restructuring without state intervention. Although some of the existing regulatory mechanisms could be activated in the course of the crisis, they were not sufficient to absorb a systemic risk of international scope.

In April 2024, the Federal Council conducted an in-depth evaluation of the regulation of systemically important banks and presented a package of measures in its report on banking stability. In its report of December 2024, the parliamentary investigatory commission "Management of the authorities - CS emergency merger" (PUK) drew lessons from the Credit Suisse crisis and also identified a need for action.

In particular, a lack of feasibility of the existing recovery and resolution plans, a lack of clarity regarding management responsibilities and insufficient regulatory intervention options on the part of the supervisory authority were identified as key weaknesses. The Federal Council therefore sees an urgent need for action.

The most important innovations at a glance

The measures adopted by the Federal Council pursue the following three overarching objectives:

-

Strengthening prevention: A central element of the reform is the increase in capital requirements for systemically important banks with foreign subsidiaries. In future, these institutions will be obliged to hold a more robust capital base in order to better absorb losses, including in foreign business. In addition - alongside other measures - management responsibility within the banks will be more clearly regulated in order to promote individual responsibilities ("senior managers regime").

-

Expand crisis instruments: The requirements for recovery and resolution plans, i.e. restructuring and resolution strategies, are to be significantly tightened. These plans should be practicable, comprehensible and also realisable in an emergency - which was not always the case at Credit Suisse.

-

Strengthen liquidity: The potential for providing liquidity via the Swiss National Bank (SNB) is to be expanded. On the one hand, legal simplifications for the transfer of collateral by banks to the SNB are to be enshrined in legislation. On the other hand, requirements are to be introduced at ordinance level that oblige banks to prepare collateralised liquidity withdrawals from the SNB and other central banks. To enable the Swiss Financial Market Supervisory Authority FINMA and the authorities to assess the situation of banks in a liquidity crisis at any time, affected banks should in future provide complete and up-to-date information and scenario analyses in a timely manner.

New senior managers regime: individual responsibilities in the event of a crisis

As part of its efforts to strengthen prevention, the Federal Council is planning to introduce a so-called senior managers regime, as already exists abroad (for example in the United Kingdom). The issue has been the subject of public debate in Switzerland for some time. This regime should enable a clear individual allocation of areas of responsibility within the executive board. Each member of top management should be able to be held accountable for his or her respective area of responsibility. The aim is to make managers more personally accountable and to bring about associated a cultural change, particularly in risk management at banks. Managers should no longer be able to hide behind complex structures or unclear responsibilities. The specific structure of the senior managers regime is still open, namely the question of which institutions and which management positions or functions will be affected and to what extent.

Strengthening FINMA

In order to be able to fulfil its supervisory function more effectively, FINMA will also be given additional powers. For example, it will be able to intervene in reorganisation processes at an earlier stage and impose personnel consequences in the event of serious deficiencies. FINMA will also be able to impose financial administrative sanctions (fines) on offending institutions.

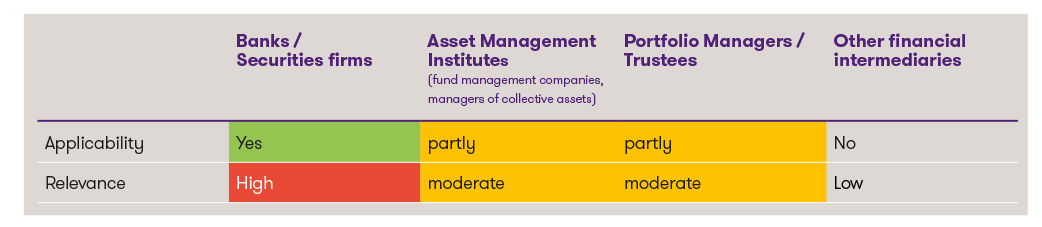

Scope of application and significance

Is the package of measures only aimed at systemically important banks, or are other financial institutions affected? The measures clearly focus on systemically important banks. However, some measures also affect other banks or financial institutions. In particular, the measures in the area of corporate governance are also to be extended to them. According to the Federal Council, the specific design of the senior managers regime should ensure that smaller and simply organised banks only have to accept a low implementation cost. As far as the new possibilities for early intervention are concerned, the changes should also apply to all banks.

For reasons of equal treatment, FINMA's new supervisory instruments (e.g. administrative fines) should apply to all FINMA supervised institutions, including insurance companies and FinIA institutions such as fund management companies and asset managers. However, FINMA will have to take the principle of proportionality into account when applying these new instruments.

Timetable

The reforms will be implemented in several stages. Some measures can be introduced more quickly via amendments to ordinances, while the amendments at federal law level require comprehensive parliamentary treatment.

An initial consultation on certain amendments to the ordinances (capital adequacy ordinance a.o.) will end in autumn 2025. The Federal Council can then adopt the ordinances, with entry into force at the beginning of 2027 at the earliest. The amendment to the federal law on capital adequacy requirements for foreign investments in the Swiss parent company and the other amendments to the federal law are not expected to enter into force until 2028 at the earliest.

Conclusion and outlook

With this comprehensive reform package, the Federal Council is drawing conclusions from one of the biggest financial crises in recent Swiss history. The new rules are intended not only to improve the systemic resilience of the financial centre, but also to strengthen the confidence of the population, the economy and international partners. Systemically important banks are most affected by the reforms. However, smaller banks and other financial institutions should also follow the legislative process closely, particularly in the area of corporate governance, and analyse and anticipate its specific impact on their own institution.