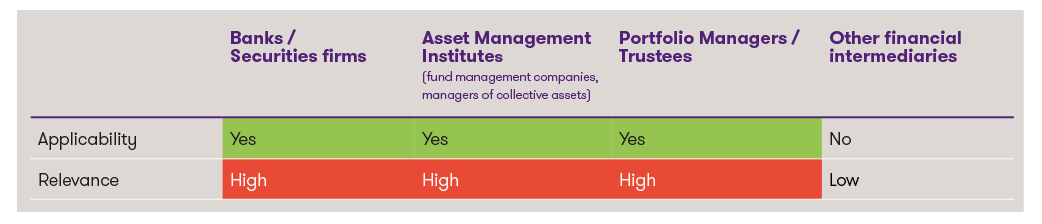

Classification1

1 This is a highly simplified presentation intended to enable a quick initial overview of the topic. Each institution should determine the relevance and specific need for action on an individual basis.

2 Self-regulatory organisation (SRO)

Purpose and content of forms B1, B2 and B3

As part of the authorisation process and ongoing supervision, FINMA and the SO require a wide range of information on the responsible persons at a bank or financial institution. This information is crucial for supervision: it forms the basis for assessing the so-called guarantor status – i.e. whether a person offers personal and professional guarantees for the irreproachable business conduct of an institution's business activities. Forms B1 (declaration concerning pending and concluded proceedings), B2 (declaration concerning qualifying holdings in the financial sector) and B3 (declaration of other mandates) are particularly important in this context.

- Form B1 must include details of all civil, criminal and administrative penalty, sanction, supervisory, disciplinary, debt enforcement and bankruptcy proceedings pending in Switzerland or abroad or concluded within the last 10 years against the guarantor personally. The same now also applies to legal entities in which the guarantor held a relevant position. For some time now, guarantors have also been required to declare any termination of previous employment relationships at the instigation of the employer due to misconduct under labour law. The latest version of the form contains further details on the declaration in the footnotes, such as the fact that fixed penalties for traffic offences are exempt from the declaration requirement.

- Form B2 is used to identify potential conflicts of interest on the part of guarantors due to qualified holdings in other companies operating in the financial sector. A holding of 10% or more (or 5% or more in the version of form B2 for banks) is subject to declaration. It is irrelevant whether the holding relates to capital or voting rights. The form does not explain in detail when a company is considered to be "active in the financial sector" and when it is not.

- The purpose of form B3 is to disclose all mandates and activities outside the licence applicant in order to make potential conflicts of interest transparent. Specifically, it asks about "other mandates and secondary occupations" and about natural or legal persons with whom the guarantor has an employment relationship. Even in its latest version, the form does not contain a precise definition of what exactly is meant by a "mandate" or "secondary occupation". An addendum was recently added to the form, stating that changes in mandates must be reported to FINMA within 60 days of the end of the financial year using a new form. However, changes relating to mandates in the financial sector must be reported immediately. The 60-day period was introduced to enable the one-time annual reporting of mandates and activities, thereby simplifying the process.

Legal basis and developments in practice

The obligation to submit these declarations arises for portfolio managers, trustees, asset management institutions and securities firms primarily from Art. 7 FinIA (licensing requirements), Art. 11 FinIA (specific guarantee requirements) and Art. 3 and Art. 3f of the Banking Act for banks, as well as from the general supervisory cooperation obligations under Art. 29 FINMASA. Violations of the latter cooperation obligations are punishable under Art. 45 FINMASA. Accordingly, anyone who intentionally provides false information to FINMA, an audit firm, a supervisory organisation, a self-regulatory organisation or an agent is liable to imprisonment for up to three years or a fine. Anyone who acts negligently is liable to a fine of up to CHF 250,000.

Forms B1 to B3 have been amended and expanded several times in recent years. Some of the changes relate to detailed wording, while others relate to content, such as the obligation to disclose mandates or the definition of relevant procedures in form B1. In practice, this means that banks and financial institutions cannot simply assume that an earlier version of a form still meets the current requirements. Although the obligation to use the latest forms is only implicit, it is binding and must be complied with.

It should be noted that, according to current practice, any changes to the declarations initially made in forms B1 – B3 are generally considered to be reportable changes of fact. For example, any changes in the secondary activities of a guarantor (even the mere discontinuation of an originally declared mandate) must be reported using a new form B3.

Uncertainties regarding form B3 – What constitutes a mandate?

Form B3 lists, among other things, all "other mandates and secondary occupations". In practice, however, there is sometimes uncertainty as to what this means exactly. Does this only include formal positions or functions in operational legal entities that are entered in the commercial register (e.g. board of directors, executive body, authorised signatory)? Or must voluntary activities also be recorded, such as membership of a school board, another non-profit committee or even the board of a leisure club? If activities such as the latter are also included, the question arises as to where the line should ultimately be drawn between insignificant (possibly also informal) private secondary employment and activities relevant to the guarantee of irreproachable business conduct. It is undisputed that this cannot apply to any purely private, unpaid "minor office" without any decision-making authority and without any connection to regulated activity. However, neither the text of the law or ordinance, nor form B3 or the accompanying explanations provide a clear answer to such questions. This lack of clarity creates a certain degree of legal uncertainty and corresponding risks for guarantors and institutions.

Risks associated with incomplete or incorrect information

In view of the supervisory authority's specific expectations regarding the reporting of changes in circumstances, there is a risk that charges will be brought if guarantors list private secondary activities (e.g. board membership in a leisure club) on renewed forms that they did not declare in their initial licence application. This could result in a penalty notice from the public prosecutor's office for violating Art. 45 para. 2 FINMASA (negligent provision of false information), combined with a fine. This can not only be a financial burden for those affected, but also damage their reputation.

Although the changes to the forms can be seen as a step towards clarifying and harmonising supervisory practice, they also entail administrative work and legal risk for institutions and guarantors. The situation can be particularly challenging for board members from professional groups such as trustees or solicitors, who regularly hold numerous additional mandates, especially for professional reasons. This creates a structural conflict of interest between everyday professional life and supervisory practice, and it is necessary to clarify the extent to which detailed disclosure does not lead to violations of other professional confidentiality obligations or data protection requirements.

It would be helpful to further clarify the legal requirements for the disclosure of mandates and secondary occupations and to create a clear distinction between activities that are subject to reporting requirements and those that are not. This would significantly reduce the risk of unnecessary proceedings and the associated damage to reputation.

Recommendations for action

Until the requirements are further specified by legislation, supervisory practice or case law, it may be advantageous for banks and other financial institutions to adopt a cautious and rather broad interpretation approach:

- Monitor forms and keep them up to date: All submitted forms should be checked for content (duty of the respective guarantor) and updated if necessary.

- Declare in case of doubt: In case of doubt, it is advisable to list all potentially relevant mandates in form B3.

Regular review: Regular (at least annual) review of the most recently submitted mandate lists can help to ensure that changes are reported in a timely manner. Changes relating to the financial sector must be reported immediately. - Establish internal processes: It may be useful to create internal procedures that encourage guarantors to report new activities quickly and in advance.

- Special care in the case of multiple mandates: Trustees, solicitors or other persons with multiple mandates should take particular care when deciding which activities to disclose and how.

- Consultation in case of uncertainty: Depending on the situation, it is advisable to consult with the relevant case officers at the SO or FINMA in advance.

Conclusion

Recent developments show that the disclosure and reporting requirements in connection with forms B1–B3 for banks and other financial institutions have become increasingly specific. The questions that remain unanswered, particularly with regard to form B3, lead to an increased legal risk for guarantors and institutions. Since even negligent errors can have criminal law consequences, it is currently advisable to adopt as comprehensive a disclosure approach as possible in practice. At the same time, further clarification of the requirements by the legislator and the supervisory authority would be helpful in order to improve the necessary legal certainty.