-

Audit Financial Services

More security, more trust: Audit services for banks and other financial companies

-

Audit Industry, Services, Institutions

More security, more trust: Audit services for national and international business clients

-

Corporate Tax

National and international tax consulting and planning

-

Individual Tax

Individual Tax

-

Indirect Tax/VAT

Our services in the area of value-added tax

-

Transfer Pricing

Our transfer pricing services.

-

M&A Tax

Advice throughout the transaction and deal cycle

-

Tax Financial Services

Our tax services for financial service providers.

-

Advisory IT & Digitalisation

Generating security with IT.

-

Forensic Services

Nowadays, the investigation of criminal offences in companies increasingly involves digital data and entire IT systems.

-

Regulatory & Compliance Financial Services

Advisory services in financial market law and sustainable finance.

-

Mergers & Acquisitions / Transaction Services

Successfully handling transactions with good advice.

-

Legal Services

Experts in commercial law.

-

Trust Services

We are there for you.

-

Business Risk Services

Sustainable growth for your company.

-

IFRS Services

Die Rechnungslegung nach den International Financial Reporting Standards (IFRS) und die Finanzberichterstattung stehen ständig vor neuen Herausforderungen durch Gesetzgeber, Regulierungsbehörden und Gremien. Einige IFRS-Rechnungslegungsthemen sind so komplex, dass sie generell schwer zu handhaben sind.

-

Abacus

Grant Thornton Switzerland Liechtenstein has been an official sales partner of Abacus Business Software since 2020.

-

Accounting Services

We keep accounts for you.

-

Payroll Services

Leave your payroll accounting to us.

-

Real Estate Management

Leave the management of your real estate to us.

-

Apprentices

Career with an apprenticeship?!

1 What makes the Swiss market particularly attractive?

The Swiss market is considered a revenue gem in the cross-border e-commerce business. The increased purchasing power of Swiss consumers compared to other European countries as a result of the appreciation of the Swiss franc against the euro or the American dollar has certainly contributed to this over the last few years. In addition, foreign web shops often offer a larger range of products compared to the relatively small size of the Swiss domestic market. Moreover, the immediate availability of certain articles can be better with foreign web shops than with domestic ones. Last but not least, large foreign web shops benefit from greater purchasing power and thus lower prices compared to Swiss suppliers.

However, a major stumbling block in the e-commerce business when supplying the Swiss market is the customs border. If a foreign web shop succeeds in overcoming this in such a way that the customer does not notice, its chances of being perceived as customer-friendly increase, which can ultimately lead to repeat orders and thus sales increases.

|

Zalando. The clothing company Zalando, based in Germany, has shown that it is possible to overcome the border barrier without a single employee in Switzerland in such a way that it is no longer perceived by the customer. Within a few years, Zalando has managed to become the largest fashion retailer in Switzerland without operating its own shop infrastructure in Switzerland. Zalando’s annual turnover in Switzerland is around CHF 800–900 million. |

2 Customer-friendly and tax-efficient delivery

Customer-friendly delivery is central because only satisfied customers will order again from the respective web shop in the future. Even though the concept of customer friendliness is subjective and can therefore only be vaguely defined, certain aspects that have a positive influence on customer friendliness can certainly be established from general life experience.

One of the prerequisites for a customer to no longer perceive the customs border is that the final prices are already displayed in the web shop – final prices in which transport, insurance and VAT are displayed, just as the customer is used to when buying from a domestic web shop or in domestic stationary retail. Another point that has a decisive effect on customer satisfaction is the shortest possible delivery times. Of course, other factors also play a role, such as general customer service or the processing and handling of returns.

So-called DDP deliveries are considered customer friendly. According to the internationally standardised trade clauses, DDP stands for “Delivered Duty Paid” and means that the seller takes care of the entire customs and import tax processing and bears all costs up to the buyer’s doorstep. DDP deliveries can already be called the standard for a customer-friendly supply chain in cross-border e-commerce business with retail customers. For the customer, it is as if he was ordering from a domestic web shop. The border crossing is no longer perceptible to the customer.

2.1 How does an efficient and customer-friendly delivery process work in conformity with VAT?

2.1.1 Purchase in the web shop – logistics in the background

When a customer buys an item in the web shop, the intralogistics system in the background assembles the order from the warehouses, packs it and makes it ready at the ramp for collection by the consignor. The IT system sends the authorised consignor the necessary data for preparing the export declaration. After opening the corresponding customs procedure (transit), the authorised consignor in the country of departure delivers the relevant data to the authorised consignee in Switzerland. The authorised consignor and consignee are companies authorised by the customs authorities to provide corresponding services in the cross-border movement of goods. The authorised consignee declares the parcel to the Federal Customs Administration for import in Switzerland. In doing so, he provides, among other things, the data that the customs administration needs to calculate the customs duties and the import VAT.

2.1.2 What happens during customs clearance?

In the case of a VAT-efficient import, the web shop itself is the importer of the consignment. On the import customs declaration, the authorised consignee of the web shop indicates his domestic fiscal representative as the importer by address. However, the importer is not the one who also receives the goods delivered. Therefore, the authorised consignee under customs law also indicates the customer, i.e., the actual recipient of the goods, on the import customs declaration. The actual recipient is the ordering customer in Switzerland. If the authorised consignee also indicates the customs account of the web shop on the import declaration, the Federal Customs Administration can debit the customs duties and import VAT directly to this customs account, which not only speeds up the processing procedure but also makes it much easier for the web shop to obtain documents for its Swiss VAT return.

|

Customs accounts. The advantages of having your own customs account:

|

2.1.3 Parcel transport and customer delivery

The carrier takes over the prepared order (parcel) at the ramp of the warehouse and drives off towards the Swiss border. If the consignment has already been correctly declared for export and import, and the duties are debited to the web shop’s customs account, the vehicle can pass the Swiss border without delay. After the consignment arrives at the authorised consignee, the consignee notifies the customs administration that the package has been received. As soon as the Federal Customs Administration electronically releases the consignment, the transit procedure is completed and the parcel is handed over to the Swiss delivery company, which processes it in its distribution system and finally delivers it to the end customer free of charge.

2.1.4 Invoicing

The customer receives an invoice on which the Swiss VAT is indicated either in parallel electronically or physically together with the consignment. On the customer invoice, the web shop is indicated as the seller with its foreign business address. The fiscal representative of the web shop does not appear on the customer invoice to ensure that customers with feedback address the web shop directly and that corresponding queries can be processed without delay.

VAT registrationThe advantages of VAT registration:

|

2.1.5 Summary: an efficient and VAT-compliant delivery process

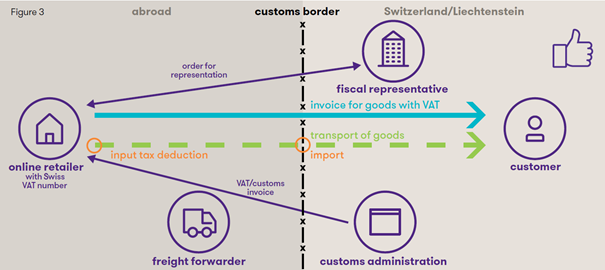

A VAT-compliant delivery process ensures that the customer does not notice the border crossing when he receives the consignment. The web shop itself can deduct the import VAT from its imports on its own behalf in the VAT return and has to account for the domestic VAT on the outgoing invoice to the Swiss customer at the applicable tax rate. The following graphic illustrates a VAT-optimised delivery process:

3 Common pitfalls

3.1 The customer must pay additional fees when accepting the goods

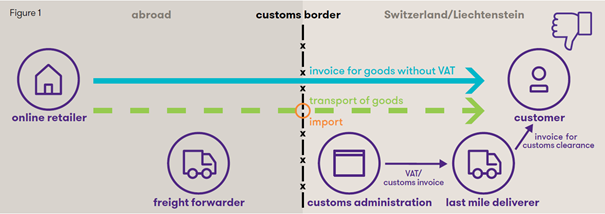

Without special precautions, when goods are shipped from abroad to Switzerland, the ordering customer is considered the importer and usually owes customs duties, import VAT and other fees. This can lead to unpleasant surprises for the customer if he receives an additional invoice for transport costs and import duties when he accepts the ordered product. The following illustration shows a delivery where the customer has ordered from a web shop that is not registered for Swiss VAT and therefore has to pay import VAT, customs duties and additional customs clearance costs when accepting delivery of the goods.

3.2 Import VAT is passed on to the forwarder in a concealed manner and is not deductible

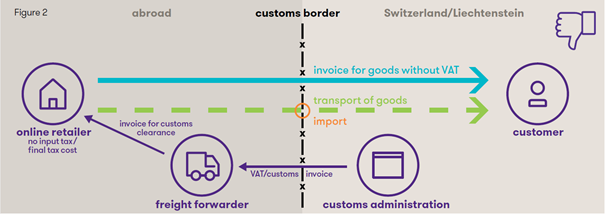

The situation is not much better if the forwarder advances customs duty, import VAT and other fees on behalf of the foreign web shop instead of the Swiss customer. The customer does not receive an additional invoice when accepting the goods, but the import VAT is then also not refundable because the foreign web shop is not registered for VAT. The following chart shows that without registration for VAT, the import tax is not deductible for either the forwarder or the web shop.

3.3 Future tightening of VAT law for foreign web shops

Cross-border e-commerce has been steadily gaining in importance for several years. VAT legislation has already been adapted to capture the economic activity of foreign web shops for tax purposes. It is foreseeable that this development will continue. Today, the Federal Tax Administration is already planning to further tighten the legal regulations for the tax liability of foreign web shops and to introduce far-reaching sanction options. For example, the Federal Tax Administration is to be given the power to impose an import ban on deliveries from foreign web shops and online platforms that have not registered for VAT in Switzerland or have not fulfilled their billing and payment obligations, and may even order the destruction of the goods. In addition, the Federal Tax Administration is to be authorised to publish the offending foreign web shops and online platforms by name in a register to which domestic customers have online access.

4 Conclusion

Grant Thornton Switzerland/Liechtenstein competently supports your web shop in the planning and implementation of a VAT-compliant and customer-friendly delivery process for Swiss and Liechtenstein customers. We look forward to hearing from you for a non-binding initial meeting in which we can evaluate the necessary measures and outline the next steps together. Don’t let the sales potential of the Swiss market go unused!