-

Audit Industry, Services, Institutions

More security, more trust: Audit services for national and international business clients

-

Audit Financial Services

More security, more trust: Audit services for banks and other financial companies

-

Corporate Tax

National and international tax consulting and planning

-

Individual Tax

Individual Tax

-

Indirect Tax/VAT

Our services in the area of value-added tax

-

Transfer Pricing

Our transfer pricing services.

-

M&A Tax

Advice throughout the transaction and deal cycle

-

Tax Financial Services

Our tax services for financial service providers.

-

Advisory IT & Digitalisation

Generating security with IT.

-

Forensic Services

Nowadays, the investigation of criminal offences in companies increasingly involves digital data and entire IT systems.

-

Regulatory & Compliance Financial Services

Advisory services in financial market law and sustainable finance.

-

Mergers & Acquisitions / Transaction Services

Successfully handling transactions with good advice.

-

Legal Services

Experts in commercial law.

-

Trust Services

We are there for you.

-

Business Risk Services

Sustainable growth for your company.

-

IFRS Services

Die Rechnungslegung nach den International Financial Reporting Standards (IFRS) und die Finanzberichterstattung stehen ständig vor neuen Herausforderungen durch Gesetzgeber, Regulierungsbehörden und Gremien. Einige IFRS-Rechnungslegungsthemen sind so komplex, dass sie generell schwer zu handhaben sind.

-

Abacus

Grant Thornton Switzerland Liechtenstein has been an official sales partner of Abacus Business Software since 2020.

-

Accounting Services

We keep accounts for you.

-

Payroll Services

Leave your payroll accounting to us.

-

Real Estate Management

Leave the management of your real estate to us.

-

Apprentices

Career with an apprenticeship?!

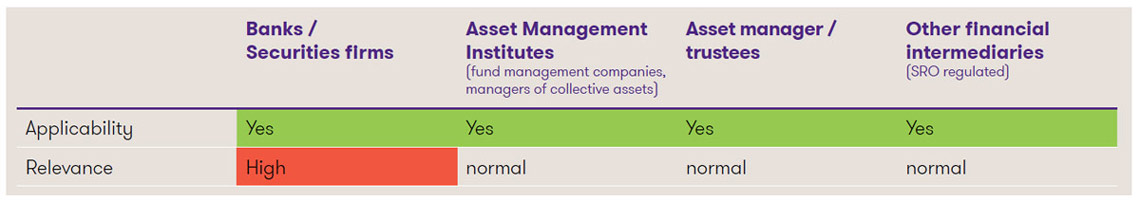

Classification 1

1This is a highly simplified presentation, which should enable a quick initial classification of the topic. Each institution should determine the relevance and the concrete need for action individually.

Legal basis in Switzerland

In Switzerland, the Embargo Act (EmbA) of 22 March 2002 forms the legal basis for sanctions. The Embargo Act is a framework law. It authorises the Federal Council to issue compulsory measures in the form of ordinances to enforce international sanctions imposed by the UN, the OSCE and Switzerland's most significant trading partners (especially the EU). In particular, compulsory measures can directly or indirectly restrict transactions involving goods and services, payment and capital transfers, and the movement of persons, as well as scientific, technological and cultural exchange.

There are currently 26 Federal Council sanction ordinances in force with measures against countries, persons and organisations. The State Secretariat for Economic Affairs SECO is responsible for the implementation and enforcement of sanctions in Switzerland. The "SESAM" database on SECO's homepage can be used to search for sanctioned persons and organisations. Persons and institutions that hold or manage funds or know of economic resources that are likely to be subject to blocking must report this to SECO without delay.

International sanctions regimes and their extraterritorial effect

Under international law, Switzerland is obliged to support the sanctions of the UN Security Council. There is no legal obligation to accept EU sanctions. Switzerland decides whether not to adopt EU sanctions at all, or to adopt them in part or in full, after a comprehensive weighing of interests. In the past, the majority of EU sanctions were adopted by Switzerland.

In addition to UN and EU sanctions, US sanctions may also be relevant for a Swiss financial intermediary. The US Office of Foreign Assets Control (OFAC) is responsible for the administration and enforcement of the sanction provisions. OFAC sanctions do not apply directly in Switzerland and there is no direct obligation for supervised financial intermediaries to comply with foreign sanctions law. Compliance with foreign sanction provisions is linked to the supervisory guarantee of irreproachable business conduct: The Swiss Financial Market Supervisory Authority FINMA expects compliance with foreign supervisory law despite the lack of direct applicability. In a ruling from 2020, the Commercial Court of Zurich affirmed the duty of a Swiss bank to comply with US sanctions law, citing the serious and non-negligible risk of being confronted with serious US fines in the event of non-compliance or, in the worst case, even being cut off from the US financial system. In 2021, the Federal Supreme Court upheld this obligation, which is based on Swiss supervisory law. Other financial institutions, such as those under FinIA, are also subject to a corresponding supervisory guarantee requirement. It is therefore advisable for all Swiss financial institutions to pay due attention to sanctions compliance by conducting a risk assessment.

For Swiss financial intermediaries, so-called secondary sanctions can become relevant, i.e. sanctions that are directly directed at companies and persons in other states (rare), or transaction prohibitions if the prohibited transactions have a certain connection to the sanctioning state (more frequent). In the case of OFAC sanctions, the required connection to the US is already given if transactions are executed using US financial market infrastructure, which is the case for most transactions in USD.

A duty to comply with foreign sanctions (such as OFAC and EU sanctions in particular) is likely to exist primarily if non-compliance would have significant consequences for the main business of the financial institution. In any case, a careful assessment of the risks should be made. In assessing the risk, the respective foreign exposure and the impending consequences of a sanction violation are decisive. The fact that Swiss companies and individuals have now also been sanctioned by the USA must also be taken into account.

Complex ownership and sanctions by extension (50% Rule)

Not only natural persons and legal entities listed by name in the sanctions lists are sanctioned under the US and EU sanctions regimes, but also companies that are 50% or more owned or controlled by one or more listed persons (with marginal differences between the US and the EU). Switzerland's sanction regulations also refer to funds or companies that are owned or controlled by listed persons. What is specifically understood by control is not defined more precisely in Switzerland at the legislative or ordinance level; an analogous handling as in the EU is recommended. Financial institutions should therefore ensure that they also have the corresponding data at their disposal in order to be able to recognise companies controlled by sanctioned persons (especially with regard to the 50% Rule). Since the true ownership structure can be concealed in many ways (shareholdings below the thresholds, no disclosure, circular ownership structures, etc.), it is conceivable that in future more comprehensive databases should be used to identify whether a company is controlled by a sanctioned person in a complex ownership structure.

Measures

In addition to a precise contractual framework, the financial institution should define clear internal processes for the appropriate handling of sanctions risks. This may include, for example, the implementation of an ongoing reconciliation of the client base and the persons involved in client transactions (principals/beneficiaries) with the relevant sanctions lists. Further information and personal connections of the customer, which are known to the financial service provider due to the know-your-customer principle (KYC), must also be taken into account in a risk-adequate manner. If necessary, an institution should carry out a risk assessment to determine the relevance of sanctions lists of third countries. When using external database providers, it should be checked whether they also cover the data according to the 50% regulations (cf. explanations above) and whether these service providers offer sufficient guarantee for compliance with the applicable confidentiality obligations and data security. In any case, sanctions list matching should be appropriately integrated into the internal control system (ICS). Depending on the business model and size of the institution, the implementation of IT-supported monitoring processes is indicated.

Consequences in the event of violations

The EmbA makes various violations of the provisions of the law or ordinance punishable, whereby even the negligent violation of reporting obligations to SECO is punished. In serious cases of violations of prescribed compulsory measures, a custodial sentence of up to 5 years or a monetary penalty may be imposed. Criminal liability may lie with the natural person committing the offence, the principal or employer or the board of directors/management or the company itself. Violation of both domestic and foreign sanction measures may also result in supervisory consequences and damage to the company's reputation.

Conclusion

The importance of the cross-border financial services business and the interconnectedness of Swiss financial intermediaries with international markets requires them to increasingly deal with foreign sanction measures. In addition to the implementation of Swiss sanctions and depending on their business model, they should therefore increasingly take foreign sanction measures into account in their risk management and internal processes. This can mitigate the risks of violating the supervisory guarantee requirement and suffering reputational damage.

Do you have questions about the Embargo Act and how to deal with sanctions? Our specialists from the Regulatory & Compliance FS Team will be happy to assist you. We look forward to hearing from you.