-

Audit Industry, Services, Institutions

More security, more trust: Audit services for national and international business clients

-

Audit Financial Services

More security, more trust: Audit services for banks and other financial companies

-

Corporate Tax

National and international tax consulting and planning

-

Individual Tax

Individual Tax

-

Indirect Tax/VAT

Our services in the area of value-added tax

-

Transfer Pricing

Our transfer pricing services.

-

M&A Tax

Advice throughout the transaction and deal cycle

-

Tax Financial Services

Our tax services for financial service providers.

-

Advisory IT & Digitalisation

Generating security with IT.

-

Forensic Services

Nowadays, the investigation of criminal offences in companies increasingly involves digital data and entire IT systems.

-

Regulatory & Compliance Financial Services

Advisory services in financial market law and sustainable finance.

-

Mergers & Acquisitions / Transaction Services

Successfully handling transactions with good advice.

-

Legal Services

Experts in commercial law.

-

Trust Services

We are there for you.

-

Business Risk Services

Sustainable growth for your company.

-

IFRS Services

Die Rechnungslegung nach den International Financial Reporting Standards (IFRS) und die Finanzberichterstattung stehen ständig vor neuen Herausforderungen durch Gesetzgeber, Regulierungsbehörden und Gremien. Einige IFRS-Rechnungslegungsthemen sind so komplex, dass sie generell schwer zu handhaben sind.

-

Abacus

Grant Thornton Switzerland Liechtenstein has been an official sales partner of Abacus Business Software since 2020.

-

Accounting Services

We keep accounts for you.

-

Payroll Services

Leave your payroll accounting to us.

-

Real Estate Management

Leave the management of your real estate to us.

-

Apprentices

Career with an apprenticeship?!

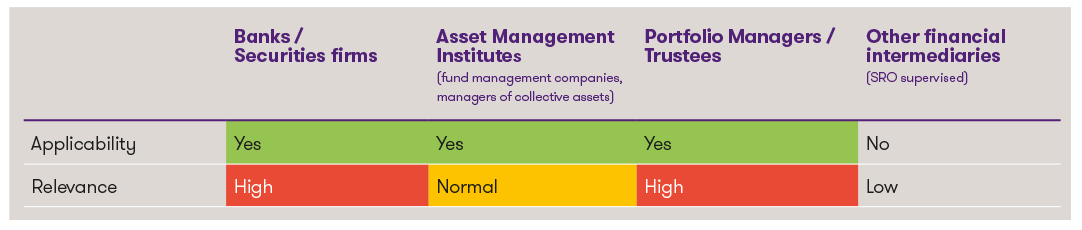

Classification of the new regulation1

1 This is a highly simplified presentation intended to enable a quick initial categorisation of the topic. Each institution should determine the relevance and the specific need for action individually and specifically.

Background

The Financial Services Act (FinSA), which has been in force since 1 January 2020, aims to strengthen investor protection and increase the competitiveness of the Swiss financial market. The central objective is to strengthen investor confidence in the financial market through detailed rules of conduct and transparency. In particular, this includes requirements for client classification, behavioural obligations, transparency and the management of conflicts of interest. FINMA drafted the circular with the aim of reducing uncertainty in the application of the FinSA and promoting standardised practice among financial service providers by providing clear and precise guidelines.

Key contents of the new circular

Compared to other FINMA circulars, the draft of the new FINMA circular is rather short, which indicates a deliberately cautious expansion of the existing rules of conduct and an adherence to principle-based regulation. However, the accompanying explanatory report reveals further specific expectations of FINMA regarding the practical implementation of FinSA. The circular only specifies the FinSA rules of conduct, i.e. other key parts of the FinSA, such as the requirements in the area of offering financial instruments (issues relating to distribution, prospectus obligations, etc.) are not covered by the circular. Selected key contents of the draft are outlined below:

- Duty to provide information: Financial service providers must provide their customers with all relevant information in a comprehensible form to enable them to make an informed decision. This includes information about the company, the services offered and the associated risks. In this respect, the circular now expressly requires a differentiation between transaction-related and portfolio-related investment advice. It also stipulates specific risk disclosure obligations in the area of contracts for difference and in relation to margin calls (if such exist). Detailed information obligations are also stipulated in the area of securities lending, although the content of these is based on previously codified FINMA practice on securities lending.

- Concentration risks: The draft also addresses the issue of concentration risks in particular. These arise when there is a concentration of risks in a few positions or issuers in a client's portfolio. Financial service providers must take appropriate measures to recognise, assess and manage such risks. This includes the regular review and diversification of portfolios in order to ensure that no excessive risks arise from concentration. The circular requires clients to be actively informed about concentration risks that are unusual for the market (from 10% in individual securities or from 20% for individual issuers).

- Appropriateness and suitability test: When recommending financial products or services, the provider must take into account the client's knowledge, experience, financial circumstances and investment objectives. The draft specifies that the financial service provider must enquire about the client's knowledge and experience for each relevant investment category used in the financial service. The explanatory report provides further clarification on the appropriateness and suitability test: simply ascertaining the client's net assets is not sufficient. Instead, nominal values regarding income, assets and financial obligations must be collected, unless the financial service provider can prove that the client is able to calculate their loss-bearing capacity themselves. It is clarified that the institutions may continue to rely on the information provided by the customer in principle, but that they must check the plausibility of this information and ensure that there are no indications of facts that contradict the information provided.

- Conflicts of interest: The regulations on identifying and managing conflicts of interest are further specified. Financial service providers must have appropriate organisational measures in place to identify and avoid conflicts of interest or, if unavoidable, to make them transparent and manage them. Clients must be informed if some or all of their own financial instruments are used. Simultaneous charging of fees at service and financial product level (‘double dipping’) must be made clear to the customer. When using third-party financial instruments, a selection process must be defined based on objective criteria that are customary in the industry.

- Retrocessions: Another important aspect of the draft concerns the issue of retrocessions. The existing requirements are concretised in both formal and material terms, also taking into account the case law of the Federal Supreme Court. Firstly, the draft requires that the information on retrocessions in form contracts must be visually emphasised and must be physically available at, or be easy to find electronically. If the actual amount of the retrocessions cannot be determined before the start of the service, information must be provided on the bandwidths with regard to the various product classes and - in the case of asset management and portfolio-related investment advice - in particular also on the bandwidths based on the total portfolio value. If a client requests detailed information on the contributions actually received, this disclosure must be provided free of charge.

Effects on practice

The new regulations will have implications for the practice of financial service providers. In particular, internal processes, documentation and controls will need to be revised in order to fulfil the new requirements. Smaller financial service providers could face particular challenges in this regard and should consider the possibility of external support to ensure implementation in compliance with the regulations.

Conclusion and outlook

The draft of the new FINMA circular on FinSA represents a significant step towards further concretising and clarifying the legal requirements. Financial service providers are invited to actively utilise the consultation phase and submit their comments. This offers the opportunity to contribute practical experience and specific concerns in order to ensure that the final regulations are designed in a practical manner.

The final FINMA Circular is scheduled to enter into force at the beginning of 2025.

We will be happy to provide you with detailed information and support in implementing the new requirements.