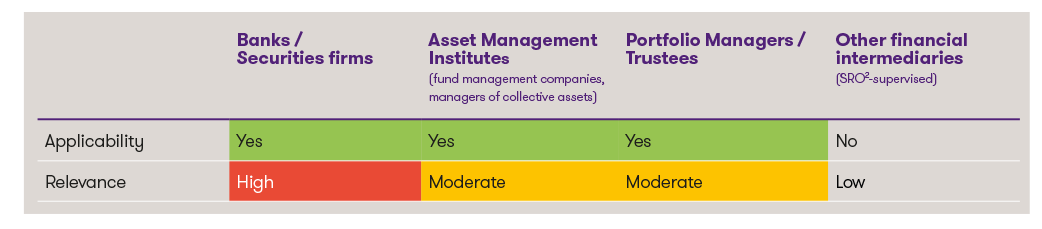

Classification1

1 This is a highly simplified presentation intended to provide a quick initial overview of the topic. Each institution should determine the relevance and specific need for action on an individual basis.

2 Self-regulatory organisation (SRO)

Background

FATCA is a unilateral US regulation that applies worldwide to all countries. The aim of FATCA is to combat tax evasion in the US through assets held abroad. FATCA requires all financial institutions (see below for more information on this term) to disclose information about US accounts to the US tax authorities and came into force around 10 years ago, on 1 January 2014. In Switzerland, the specific implementation of FATCA is governed by an agreement between Switzerland and the US, which came into force on 30 June 2014. FATCA provides for two types of information exchange. These are known as "Model 2" and "Model 1" and differ mainly in the type (direct or indirect) of reporting.

Model 2 (previous model)

In Switzerland, reporting has so far been carried out in accordance with Model 2. This means that Swiss financial institutions have reported the data of affected US clients directly to the US tax authority, the IRS (Internal Revenue Service). The consent of the affected US clients was required for the information to be passed on. The data of customers who did not consent to the exchange of information was reported in aggregated form. The IRS was then able to request further information from the Swiss Federal Tax Administration (SFTA) under the FATCA Agreement as part of a FATCA group request. Model 2 is a non-reciprocal model. This means that the exchange of information was only carried out unilaterally by Switzerland to the US.

Model 1 (new model)

New, probably from 1 January 2027, Switzerland will switch to Model 1. To this end, financial institutions will no longer have to report customer information directly to the IRS, but to the SFTA, which will forward the data to the US. In addition to strengthening legal certainty and reducing duplication, the change in model also has the advantage for banks that the obligation to undergo regular FATCA certification will no longer apply. Unlike Model 2, Model 1 also provides for the mutual exchange of information and is referred to as a reciprocal model. Switzerland will therefore also receive information from the US in future, although there are differences in the data transmitted: the US only provides information on financial accounts held in the name of natural persons at US banks. Accounts held by legal entities are excluded.

Indications of US tax liability

Natural persons and legal entities with US tax liability are affected by the FATCA reporting requirement. In the case of natural persons, there is at least one indication of US status – and thus tax liability – if they are US citizens (including US place of birth), are resident or have a postal or residential address in the US or have a US telephone number. A residence permit in the US ("green card") or primary residence in the US (according to the "substantial presence test") also normally establishes US tax liability. Legal entities are considered US persons if they were established under US law. Domiciliary companies in which one or more controlling persons are US citizens or resident in the US are also generally subject to US tax liability.

Reporting vs. non-reporting Swiss financial institutions

Both the old and the new FATCA Agreements divide Swiss financial institutions into two categories: reporting and non-reporting Swiss financial institutions. The latter category is defined in Annex II of the Agreement. This includes, in particular, Swiss investment advisors and asset managers if they provide investment advisory and asset management services for clients on the basis of a power of attorney and if the account or custody account is held with a reporting institution. In these cases, the reporting institution assumes the reporting obligation. Reporting financial institutions are all financial institutions that are not non-reporting Swiss financial institutions. These typically include banks.

Specific action required by banks

All reporting Swiss financial institutions had to register with the IRS by 1 July 2014. This registration remains valid in principle. Re-registration is only necessary in exceptional cases, such as when the status changes. After registration, the reporting financial institution receives a GIIN number (Global Intermediary Identifying Number).

Specific action required by asset managers

Under the old FATCA Agreement, asset managers and managers of collective asset also had the option, but not the obligation, to register with the IRS and were assigned a GIIN number. Upon successful registration, they were granted "registered deemed compliant" status, which means that they were considered to be FATCA-compliant registered financial institutions. This status is now being abolished under Model 1. As a result, asset managers who are registered and have a GIIN number must deregister with the IRS. Upon deregistration, they will also lose their GIIN number. They will now only have the option of being considered "certified deemed compliant", which requires self-certification using the US form "W-8BEN-E". This is the status that asset managers who are not currently registered with the IRS already have. Asset managers generally have until the new FATCA Agreement comes into force, i.e. until 1 January 2027, to deregister with the IRS. In addition, once deregistration has been completed, asset managers should self-certify as "certified deemed compliant" as soon as possible to all banks and business partners with whom they previously documented their "registered deemed compliant" status and associated GIIN number. Otherwise, one risks being treated as a non-FATCA-compliant financial institution, especially if they check the previously provided GIIN on the IRS website and can no longer find it there due to the deregistration. It is advisable to address this issue at an early stage, as contact with US authorities can sometimes be lengthy.

New login for the FATCA Registration System

The IRS has updated the FATCA registration system and equipped it with new, secure login options. Since 14 July 2024, access is only possible via the webpages https://login.gov or https://ID.me. Multi-factor authentication is also mandatory. Furthermore, existing users can only use their login if they are also registered as a "Responsible Officer" or "Point of Contact" in the portal.

Conclusion and outlook

The specific details of how the FATCA Agreement will be implemented in Swiss law are currently the subject of various negotiations. The Federal Council opened the consultation process on 7 March 2025, which lasted until 14 June 2025. After evaluating the comments, the Federal Council will submit a corresponding draft law to Parliament. The change in model will probably involve some initial effort, but in the long term, the administrative burden should be reduced by establishing clear reporting channels and responsibilities and avoiding duplication, thereby strengthening the competitiveness of Switzerland as a financial centre.