-

Audit Industry, Services, Institutions

More security, more trust: Audit services for national and international business clients

-

Audit Financial Services

More security, more trust: Audit services for banks and other financial companies

-

Corporate Tax

National and international tax consulting and planning

-

Individual Tax

Individual Tax

-

Indirect Tax/VAT

Our services in the area of value-added tax

-

Transfer Pricing

Our transfer pricing services.

-

M&A Tax

Advice throughout the transaction and deal cycle

-

Tax Financial Services

Our tax services for financial service providers.

-

Advisory IT & Digitalisation

Generating security with IT.

-

Forensic Services

Nowadays, the investigation of criminal offences in companies increasingly involves digital data and entire IT systems.

-

Regulatory & Compliance Financial Services

Advisory services in financial market law and sustainable finance.

-

Mergers & Acquisitions / Transaction Services

Successfully handling transactions with good advice.

-

Legal Services

Experts in commercial law.

-

Trust Services

We are there for you.

-

Business Risk Services

Sustainable growth for your company.

-

IFRS Services

Die Rechnungslegung nach den International Financial Reporting Standards (IFRS) und die Finanzberichterstattung stehen ständig vor neuen Herausforderungen durch Gesetzgeber, Regulierungsbehörden und Gremien. Einige IFRS-Rechnungslegungsthemen sind so komplex, dass sie generell schwer zu handhaben sind.

-

Abacus

Grant Thornton Switzerland Liechtenstein has been an official sales partner of Abacus Business Software since 2020.

-

Accounting Services

We keep accounts for you.

-

Payroll Services

Leave your payroll accounting to us.

-

Real Estate Management

Leave the management of your real estate to us.

-

Apprentices

Career with an apprenticeship?!

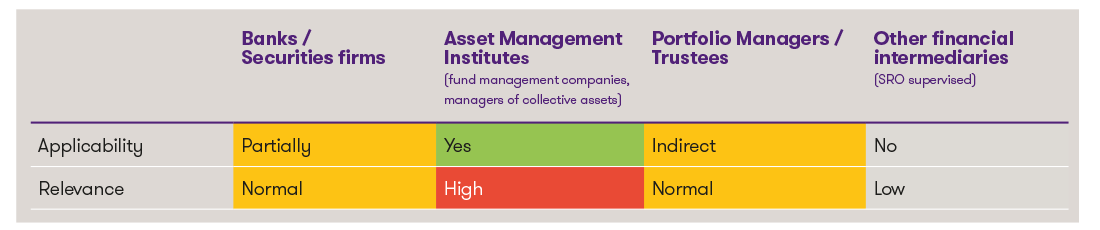

Classification of the amendments1

1 This is a highly simplified presentation intended to enable a quick initial categorisation of the topic. Each institution should determine the relevance and the specific need for action individually and specifically.

Pursuant to Art. 118a para. 2 CISA, the L-QIF continues to be subject to the provisions of the CISA and the associated CISO. Where no specific provisions or simplifications are stipulated, it is therefore subject to the same provisions as other forms of collective investment schemes.

In addition to the new provisions on the L-QIF, other important amendments were made to the CISO, particularly in the area of liquidity risk management, which will be the subject of a separate article. This article highlights exclusively chosen elements of the L-QIF.

Simplifications for the L-QIF compared to conventional collective investment schemes

Obligation to publish a prospectus

The obligation to prepare a prospectus does not apply to the L-QIF (Art. 50 para. 1 FinSA).

Authorisation/approval requirement

Neither the L-QIF nor the associated documents (e.g. collective investment agreement, articles of association, investment regulations, etc.) require authorisation from FINMA. Accordingly, any subsequent changes to these documents are also not subject to authorisation. As a direct consequence, other provisions linked to the authorisation/approval requirement, in particular Art. 14 CISA (authorisation requirements, organisational requirements), no longer apply. For the same reason, all provisions containing FINMA's decision-making and/or supervisory powers do not apply to the L-QIF and have either been deleted or replaced by special provisions.

Investment regulations

Special and more liberal provisions apply to the L-QIF with regard to investment decisions. In particular, the CISA does not stipulate any requirements for the type of investments and risk diversification for the L-QIF.

The investments can therefore include all conceivable types. In its dispatch, the Federal Council mentions everything from securities and precious metals to real estate and infrastructure projects through to cryptocurrencies, wine and art. It also states that investments "that have limited marketability, are subject to high price fluctuations, have limited risk diversification or are more difficult to value" can also be made.

These freedoms are limited to the extent that the L-QIF must also set out the investment strategy to an appropriate extent in its fund and advertising documents and provide information on the associated risks. This applies both to the type of investments and regulations relating to risk diversification, e.g. the maximum percentage of fund assets that may be invested with the same debtor. The Federal Council's dispatch explicitly states that simply stating that the L-QIF is free in its investment decisions and risk diversification is not sufficient.

It should also be noted that appropriate liquidity management must also be in place for L-QIFs and that special regulations apply to the group of investors for L-QIFs that invest directly in real estate.

Requirements and restrictions of the L-QIF

Authorised form of the fund

The L-QIF may be a contractual fund or take the legal form of an investment company with variable capital (SICAV) or a limited partnership for collective investment (KmGK). The form of an investment company with fixed capital (SICAF) is not open to the L-QIF.

Investor class

The L-QIF is open exclusively to qualified investors. In addition to professional and institutional clients in accordance with FinSA, this also includes all clients with a long-term asset management or investment advisory mandates, unless they have declared their status as non-qualified investors in writing.

Administration

The specific requirements for managing an L-QIF depend on its form:

- In the case of L-QIFs in the form of a contractual fund, the fund management company still requires authorisation from FINMA. It may delegate the investment decisions to a manager of collective assets.

- An L-QIF in the form of a SICAV must delegate the administration and investment decisions to one and the same fund management company. As with a contractual fund, investment decisions may be delegated to a manager of collective assets.

With regard to the delegation of investment decisions, it should be noted that if a delegation to a manager of collective assets is permissible, the delegation to an institution with a higher position in the authorisation cascade (e.g. a bank) is also automatically permissible.

However, the de minimis exemption of Art. 24 para 2 FinIA cannot be applied to L-QIF, as a de minimis portfolio manager does not have a licence as a manager of collective assets in accordance with Art. 24 FinIA but a licence in accordance with Art. 17 FinIA.

Designation / Information

Irrespective of the legal form, all L-QIFs must use the designation "Limited Qualified Investor Fund" or "L-QIF" on the first page of their fund documents and in any advertising material and point out their (lack of) authorisation/supervisory status. In addition, the chosen name of the fund, SICAV or limited partnership may not be "securities fund", "real estate fund", "other fund for traditional investments" or "other fund for alternative investments".

Tax treatment

Not a specific restriction of the L-QIF but still worth mentioning: The L-QIF is subject to the same tax treatment as the "classic" fund structures. In particular, this means that distributions and reinvested net income are subject to withholding tax of 35%. This limits the attractiveness of the L-QIF for certain groups of investors (especially foreign investors).

Direct investments in property

If an L-QIF invests its funds directly in real estate, it may only be open to investors who are professional clients in accordance with Art. 4 para. 3 let. a-h FinSA. In other words, the following persons are excluded from investing in such L-QIFs, although they would generally be considered qualified investors under CISA:

- Private clients with a permanent investment advisory or asset management mandate;

- Private clients who are considered professional clients under FinSA due to an opting-out;

- Private investment structures with professional treasury set up for wealthy private clients.

This provision is intended to prevent wealthy private individuals from using an L-QIF to optimise taxes on real estate investments, thereby causing tax losses for the Confederation and cantons. However, L-QIFs that invest their funds indirectly in property, e.g. through shares in property investment companies, are not affected by this restriction.

Status change to L-QIF

From 1 March 2024, an authorised collective investment scheme can in principle relinquish its authorisation and become an L-QIF, provided the special requirements of the L-QIF are met. This requires authorisation from FINMA and, depending on the form of the L-QIF, further requirements such as the approval of the custodian bank.

The process of informing investors about the planned change of status and obtaining their consent is specified in Art. 126c CISO. It should be noted that FINMA is granted certain regulatory powers in this area.

Conclusion and outlook

The L-QIF provides the Swiss financial centre with a new fund structure that can be set up more quickly, more cost-effectively and more flexibly. It remains to be seen how the industry will react to these changes. However, interesting application possibilities are already emerging for providers focussed on Swiss investors. For example, an L-QIF can be used by family offices or pension funds to invest jointly and promptly in start-ups