-

Audit Financial Services

More security, more trust: Audit services for banks and other financial companies

-

Audit Industry, Services, Institutions

More security, more trust: Audit services for national and international business clients

-

Corporate Tax

National and international tax consulting and planning

-

Individual Tax

Individual Tax

-

Indirect Tax/VAT

Our services in the area of value-added tax

-

Transfer Pricing

Our transfer pricing services.

-

M&A Tax

Advice throughout the transaction and deal cycle

-

Tax Financial Services

Our tax services for financial service providers.

-

Advisory IT & Digitalisation

Generating security with IT.

-

Forensic Services

Nowadays, the investigation of criminal offences in companies increasingly involves digital data and entire IT systems.

-

Regulatory & Compliance Financial Services

Advisory services in financial market law and sustainable finance.

-

Mergers & Acquisitions / Transaction Services

Successfully handling transactions with good advice.

-

Legal Services

Experts in commercial law.

-

Trust Services

We are there for you.

-

Business Risk Services

Sustainable growth for your company.

-

IFRS Services

Die Rechnungslegung nach den International Financial Reporting Standards (IFRS) und die Finanzberichterstattung stehen ständig vor neuen Herausforderungen durch Gesetzgeber, Regulierungsbehörden und Gremien. Einige IFRS-Rechnungslegungsthemen sind so komplex, dass sie generell schwer zu handhaben sind.

-

Abacus

Grant Thornton Switzerland Liechtenstein has been an official sales partner of Abacus Business Software since 2020.

-

Accounting Services

We keep accounts for you.

-

Payroll Services

Leave your payroll accounting to us.

-

Real Estate Management

Leave the management of your real estate to us.

-

Apprentices

Career with an apprenticeship?!

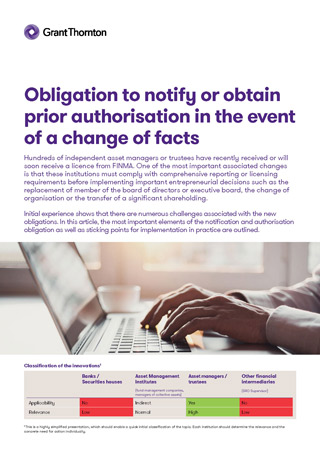

Classification of the innovations1

1This is a highly simplified presentation, which should enable a quick initial classification of the topic. Each institution should determine the relevance and the concrete need for action individually.

Basics

The licensing requirements must be complied with at all times. For asset managers and trustees, this results in the obligation to inform the supervisory organisation (SO) in the event of changes to the facts on which the authorisation is based (Art. 22 FINIO). Article 8 of the FINIA distinguishes between a reporting obligation on the one hand and a licensing obligation on the other.

Overview of changes requiring authorisation (FINMA and SO)

If the change is of material significance, Art. 8 para. 2 FINIA provides not only for a duty to notify the SO but also for a duty to obtain authorisation from FINMA. FINMA consults the SO as part of its assessment. Changes requiring authorisation are all those changes that are to be classified as material changes pursuant to Art. 8 para. 2 FINIG and Art. 10 FINIV (not exhaustive). Material changes include in particular:

- Changes to the organisational and shareholder documents;

- Changes in the persons entrusted with the administration and management;

- Changes in minimum capital and own funds, in particular falling below the minimum requirements;

- Facts that are likely to call into question the good reputation or the guarantee of irreproachable business activity of the financial institution or of the persons entrusted with management duties or of the holders of a qualified participation, namely the initiation of criminal proceedings;

- Facts that call into question the prudent and sound business activities of the financial institution due to influence exerted by holders of a qualified participation;

Foreign business (including the establishment/acquisition/discontinuation of subsidiaries or branches and qualified participations in companies abroad).

This catalogue of mandatory changes listed in the law and the ordinance, which must be approved directly by FINMA, has been significantly concretised and expanded by published guidelines of the SO, in that the following circumstances are also explicitly deemed to be material and thus subject to FINMA approval:

- New holders of a qualifying holding;

- Cancellation / change of professional indemnity insurance;

- Transfer of tasks of any kind (case-by-case consideration of whether it is a transfer of essential tasks):

- Transfer of a task;

- Change of appointee;

- Change of the person(s) responsible for the delegated task at the commissioner's office;

- Change of the person responsible at the licensee;

- Change of AO;

- Merger, demerger, conversion and transfer of assets according to FusG;

- New qualifying holdings and mandates of persons entrusted with ultimate direction or management (incl. B2 and B3 forms);

- Other material changes of facts on which the authorisation is based.

According to the wording of Art. 8 para. 2 FINIG, authorisation should be obtained from FINMA in advance.

The application for change must be submitted via FINMA's survey and application platform (EHP) and essentially corresponds to the two-step process of the authorisation procedure. Thus, the application for amendment must first be sent to the SO and its feedback must be awaited. The SO's feedback must then be submitted to FINMA via the EHP together with the licence amendment form. In its preliminary review of the change requiring authorisation, the SO mainly focuses on the formal aspects. The substantive examination of the licensing requirements is the task of FINMA. This can naturally lead to queries, requests for changes or conditions by FINMA, and sometimes also to delays. This process is concluded with the issuing of a (declaratory) decision by FINMA and the issuing of a fee invoice, which must be paid by the asset manager or trustee.

Changes subject to notification (SO)

According to Art. 8 para. 1 FINIA, all other changes to the facts on which the authorisation is based must be reported to the SO without first obtaining authorisation from FINMA. FINMA has not published any further details on the facts that must be reported. The SO have in turn filled this gap with a published catalogue of facts. Accordingly, the following changes, for example, must be reported to the SO in advance:

- Omission of a qualified participating person

- Change in the person responsible for risk management / internal control

- Change in the person responsible for compliance

- Establishment / acquisition / discontinuation of subsidiaries and qualified participations in companies in Switzerland

- Mandate / change of audit firm

- Connection to / change of ombudsman service

- Change of address of the financial institution

- Reports submitted to the Money Laundering Reporting Office (MROS) concerning business relationships with significant assets (Art. 22a AMLO-FINMA)

The law does not contain any provisions on the exact time of notification. However, in order not to unnecessarily increase the burden on both supervised entities and supervisory organisations, the reporting obligation should be interpreted rather restrictively. According to FINMA's consistent practice, the report must be submitted before the occurrence of the reportable facts or event. In the case of changes to facts over which the licensee has only limited or no influence, the report must be submitted immediately after becoming aware of them.

The notification is made to the SO because they are responsible for ongoing supervision. The changes can be notified to the SO by e-mail or by post. The SO is obliged to periodically forward the reported changes to FINMA.

Matters not subject to reporting requirements

For the sake of completeness, the supervisory organisations have also published a list of examples showing the changes that do not require authorisation or notification. These include, in particular, changes in staff, individual new asset management mandates or other changes in premises and infrastructure.

Sticking points and challenges

In practice, the interpretation and specification of Art. 8 FINIA by the supervisory authorities means that many more changes are now subject to approval than can be inferred from the wording of FINIO (Art. 10). For example, a change in the persons responsible for delegated tasks (outsourcing) or the termination and amendment of professional liability insurance must also be approved in advance by FINMA. As a result, licensed asset managers or trustees tend to have to repeatedly submit new licence applications to FINMA, even in the case of relatively minor changes or events, and also submit these to the SO in advance. An example of this is an adjustment to the geographical area of business triggered by the change of residence of an important client, which can result in a change to the organisational and business regulations that requires authorisation. As far as can be seen, higher-regulated institutions such as banks do not have a comparable level of detail in their reporting obligations. This strict handling of the reporting obligations leads to delays and additional costs for many asset managers or trustees, especially since a change request is often necessary for relatively minor adjustments in the organisation or in the business model. In addition, their compliance risks increase in connection with the failure to comply with the authorisation and reporting obligations.

The broad catalogue of facts requiring authorisation also means that FINMA will be involved in the supervision of already authorised institutions on a quasi-permanent basis. The obligation to periodically report changes by the SO to FINMA pursuant to Art. 22 para. 1 FINIO will become less important, as practically most significant transactions will be classified as material and therefore directly subject to authorisation by FINMA. The question arises as to whether this ultimately does not represent a contradiction to the original intention of the legislator, according to which FINMA should only be responsible for granting licences, but not for the ongoing supervision of asset managers / trustees.

Finally, difficult questions of demarcation arise in practice. It is not always easy to assess whether a specific event is subject to authorisation or reporting requirements, or neither. If, for example, FINMA required an asset manager or trustee to define its geographical scope of business very narrowly when granting a licence (listing the individual countries served), a change in the client's place of residence can already lead to a change requiring a licence. On the other hand, if an asset manager or trustee fails to comply with the reporting obligation, he risks a complaint by the auditing company and, as a consequence, possible sanctions under supervisory law. A prior clarification with the competent supervisory authority as to whether a certain change is subject to notification or authorisation is therefore advisable.

Conclusion and outlook

Once they have received their FINIA licence, asset managers and trustees are required to notify the SO of any changes to the facts on which their licence is based or which are otherwise material, or to obtain FINMA's prior approval. It remains to be seen whether the current practice regarding authorisation and notification requirements in combination with a two-tier authorisation cascade consisting of SO and FINMA represents a promising solution for the future. Since numerous applications for changes to FINMA will be required, many asset managers or trustees could establish a kind of "ongoing interaction with FINMA", while the supervisory organisations only act as an intermediary here. Contrary to the legislator's original intention, this is likely to lead to a situation where, to a certain extent, ongoing supervision of asset managers and trustees is not only carried out by the AO, but also by FINMA. However, if the principle of ongoing supervision by the SO is to be maintained in the longer term, it would have to be examined to what extent the catalogue of facts that (also) require FINMA's approval can be reduced in favour of the AO, both at the legislative level and in practical application.