-

Audit Industry, Services, Institutions

More security, more trust: Audit services for national and international business clients

-

Audit Financial Services

More security, more trust: Audit services for banks and other financial companies

-

Corporate Tax

National and international tax consulting and planning

-

Individual Tax

Individual Tax

-

Indirect Tax/VAT

Our services in the area of value-added tax

-

Transfer Pricing

Our transfer pricing services.

-

M&A Tax

Advice throughout the transaction and deal cycle

-

Tax Financial Services

Our tax services for financial service providers.

-

Advisory IT & Digitalisation

Generating security with IT.

-

Forensic Services

Nowadays, the investigation of criminal offences in companies increasingly involves digital data and entire IT systems.

-

Regulatory & Compliance Financial Services

Advisory services in financial market law and sustainable finance.

-

Mergers & Acquisitions / Transaction Services

Successfully handling transactions with good advice.

-

Legal Services

Experts in commercial law.

-

Trust Services

We are there for you.

-

Business Risk Services

Sustainable growth for your company.

-

IFRS Services

Die Rechnungslegung nach den International Financial Reporting Standards (IFRS) und die Finanzberichterstattung stehen ständig vor neuen Herausforderungen durch Gesetzgeber, Regulierungsbehörden und Gremien. Einige IFRS-Rechnungslegungsthemen sind so komplex, dass sie generell schwer zu handhaben sind.

-

Abacus

Grant Thornton Switzerland Liechtenstein has been an official sales partner of Abacus Business Software since 2020.

-

Accounting Services

We keep accounts for you.

-

Payroll Services

Leave your payroll accounting to us.

-

Real Estate Management

Leave the management of your real estate to us.

-

Apprentices

Career with an apprenticeship?!

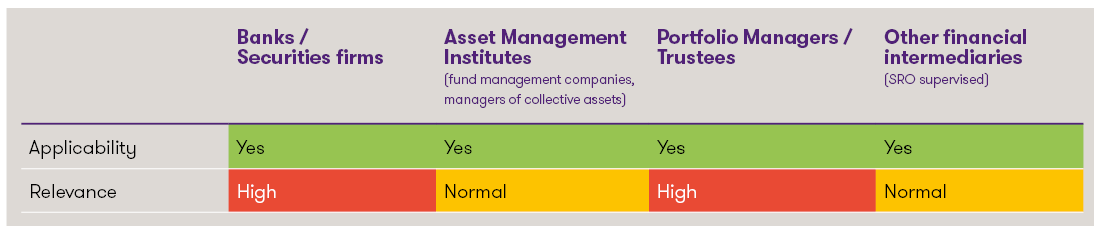

Classification of the innovations1

1 This is a highly simplified presentation intended to enable a quick initial categorisation of the topic. Each institution should determine the relevance and the specific need for action individually and specifically.

The most important elements

The new AMLA provisions are primarily intended to create even more transparency. Obligations are to be introduced, in particular, for legal entities which pose a higher AMLA risk, in order to be able to determine more quickly and reliably who is actually behind a legal structure. In addition to the introduction of a federal register of beneficial owners, certain activities of advisors and lawyers are also to be subject to the AMLA. Furthermore, financial intermediaries and advisors are to take organisational measures to more explicitly record, limit and monitor sanction risks in accordance with the Embargo Act. At the same time, the thresholds that trigger due diligence obligations for cash payments in precious metals, gemstones and real property trading are to be lowered.

Register of beneficial owners

The new Federal Act on the Transparency of Legal Entities (TJPG) provides for a register in which the beneficial owners of legal entities are entered.

- The register is to be kept in electronic form by the Federal Department of Justice and Police (FDJP).

- The personal scope of application basically includes all legal entities under Swiss law as well as certain foreign legal entities that have a close connection to Switzerland. The definition of the beneficial owner corresponds, in principle, to that of the AMLA, i.e. the natural person who ultimately controls a legal entity.

- Swiss companies should be obliged to establish and verify the identity of the beneficial owner and to report the identity as well as the type and scope of the control exercised by the beneficial owners to the register. Changes to the facts contained in the register must be reported within one month of becoming known.

- The register is not public for data protection reasons. The authorities that have access to the new register are specified exhaustively in the law. Financial intermediaries will also have access to the data in the register to the extent necessary to fulfil their due diligence obligations under the AMLA. Financial intermediaries remain obliged to determine and verify the beneficial owners. However, the introduction of the register provides financial intermediaries with a new source of information that should be consulted in the opening process or for internal clarifications.

- Financial intermediaries are obliged to report to the competent authority information from the register that they consider to be incorrect ("discrepancy reporting"). The financial intermediary only has to report discrepancies if the differences give rise to doubts as to the accuracy, completeness or timeliness of the information on the beneficial owners. Furthermore, the financial intermediary is obliged to discuss the discrepancies with the company concerned before reporting them and to allow a reasonable period of time for clarification.

The TPJG also provides for a new reporting obligation for board members, managing directors, shareholders and partners acting in a fiduciary capacity. Persons exercising such a mandate are obliged to notify the legal entity of the name or company on whose behalf they are acting. Companies entered in the commercial register must report this information to the commercial register office and, under certain conditions, to the register of beneficial owners.

Introduction of due diligence obligations for advisors and lawyers

The new draft law stipulates that the due diligence obligations under money laundering law should also apply to the performance of certain advisory activities that harbour an increased risk of money laundering. Advisors and lawyers who carry out one of the specified activities for their clients on a professional basis, in particular the preparation and execution of the following transactions, are covered by the obligation:

- Sale or purchase of a property

- Formation or establishment of a company, foundation or trust

- Management or administration of a company, foundation or trust

- Organisation of the contributions of a company

- Sale or purchase of a company

- Provision of an address or premises as a registered office for a company, foundation or trust

- Acting as a shareholder for the account of another person

The same due diligence obligations should apply to advisors and lawyers as to financial intermediaries, whereby the content and scope of the obligations are based on a risk-based approach. In particular, this includes identifying clients, determining and verifying beneficial ownership, clarifying the nature, purpose and background of the desired transaction and appropriate documentation. The bill also provides for organisational measures and reporting obligations in the event of suspicion of money laundering. Lawyers who carry out an advisory activity or an activity subject to due diligence under the Lawyers Act (FMLA/BGFA) are only subject to a reporting obligation if they carry out a financial transaction for the account of their clients. In addition, professional secrecy must be maintained.

The advisors must join a self-regulatory organisation (SRO). The supervision of lawyers subject to the FMLAwill be exercised by the cantonal authorities, which will monitor compliance with the Code of Conduct.

Further innovations

The draft law also provides for a number of other innovations:

- Explicit obligation for financial intermediaries and advisors to implement organisational measures for the effective recording, limitation and monitoring of sanction risks in accordance with the Embargo Act;

- Reduction of the threshold for cash payments in precious metals and gemstone trading from CHF 100,000 to CHF 15,000; new due diligence obligations for all cash payments in real estate trading regardless of the amount;

- Legal establishment of a uniform data standard for the transmission of MROS reports;

- Creation of a legal basis in the AMLA and FinIA to ensure a comprehensive exchange of information between SROs, SOs and FINMA;

- Revising and strengthening the supervisory activities of the SROs by creating a formal legal basis for sanctions against financial intermediaries in accordance with Art. 2 para. 3 AMLA.

Conclusion and outlook

The proposed measures take into account the development of the international standards of the Financial Action Task Force (FATF) and the Global Forum on Transparency and Exchange of Information for Tax Purposes. Once again, the Swiss financial centre is therefore under international regulatory pressure. For banks and asset managers active in the business with wealthy clients, the implementation of the planned discrepancy reporting in particular, would pose a major challenge. The consultation on the proposed legislation lasted until 29 November 2023 and the Federal Council will submit the dispatch to Parliament in 2024. The new provisions are unlikely to enter into force before 2026.

Contacts

|

Mathias Müller |

|

Mirna Matic |