-

Audit Industry, Services, Institutions

More security, more trust: Audit services for national and international business clients

-

Audit Financial Services

More security, more trust: Audit services for banks and other financial companies

-

Corporate Tax

National and international tax consulting and planning

-

Individual Tax

Individual Tax

-

Indirect Tax/VAT

Our services in the area of value-added tax

-

Transfer Pricing

Our transfer pricing services.

-

M&A Tax

Advice throughout the transaction and deal cycle

-

Tax Financial Services

Our tax services for financial service providers.

-

Advisory IT & Digitalisation

Generating security with IT.

-

Forensic Services

Nowadays, the investigation of criminal offences in companies increasingly involves digital data and entire IT systems.

-

Regulatory & Compliance Financial Services

Advisory services in financial market law and sustainable finance.

-

Mergers & Acquisitions / Transaction Services

Successfully handling transactions with good advice.

-

Legal Services

Experts in commercial law.

-

Trust Services

We are there for you.

-

Business Risk Services

Sustainable growth for your company.

-

IFRS Services

Die Rechnungslegung nach den International Financial Reporting Standards (IFRS) und die Finanzberichterstattung stehen ständig vor neuen Herausforderungen durch Gesetzgeber, Regulierungsbehörden und Gremien. Einige IFRS-Rechnungslegungsthemen sind so komplex, dass sie generell schwer zu handhaben sind.

-

Abacus

Grant Thornton Switzerland Liechtenstein has been an official sales partner of Abacus Business Software since 2020.

-

Accounting Services

We keep accounts for you.

-

Payroll Services

Leave your payroll accounting to us.

-

Real Estate Management

Leave the management of your real estate to us.

-

Apprentices

Career with an apprenticeship?!

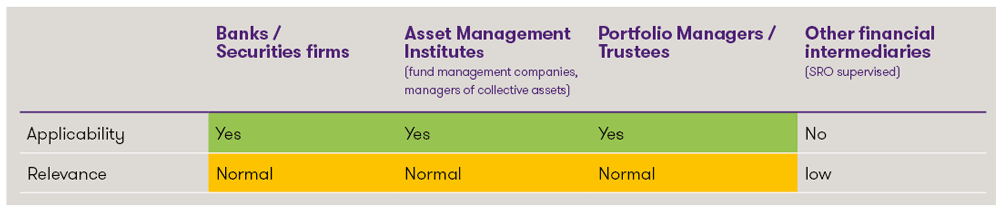

Classification of the innovations1

1 This is a highly simplified presentation intended to enable a quick initial categorisation of the topic. Each institution should determine the relevance and the specific need for action individually and specifically.

Main features and purpose

As both Switzerland and the United Kingdom are not part of the European Union, they are equally confronted with market access challenges at European level. Both countries therefore benefit from this cooperation, which is intended to facilitate cross-border business activities and thus promote competition. At the same time, the agreement should ensure the stability and integrity of the financial market and guarantee customer protection.

The starting point for the agreement is the recognition of the equivalence of the legal and supervisory framework in selected areas of the financial sector. This system of mutual recognition is supplemented by increased cooperation in supervision and regulation. Compared to a unilateral recognition of equivalence, the agreement offers greater legal certainty as it creates a bilateral basis for mutual market access. However, this also means that the agreement could be affected in the future by changes to the basic legislation of one of the countries.

Scope of application

The scope of the agreement covers the areas of banking, investment services, insurance, asset management and financial market infrastructures. The following section focuses in particular on enabling and facilitating cross-border market access for Swiss financial service providers, while the other elements of the agreement are briefly described.

Easier market access for Swiss financial service providers

The agreement enables Swiss banks, investment firms, managers of collective assets, fund management companies and portfolio managers to offer financial services to wealthy British private clients (assets of GBP 2 million or more) as well as professional and institutional clients. This can be done directly from Switzerland or as part of temporary limited assignments on site in the UK. The agreement covers traditional financial services such as asset management, investment advice and execution-only as well as ancillary services such as the granting of loans for the execution of transactions with financial instruments. As before, financial service providers can apply Swiss law and are exempt from UK authorisation and regulatory requirements.

In order to benefit from the agreement, a notification must first be submitted to the UK Financial Conduct Authority (FCA) - with a copy to FINMA - stating the services to be provided in the UK and the clients covered. This is done for the purposes of entry in a register maintained by the FCA. Relevant changes to this register entry must then be reported to the FCA on an ongoing basis (with a copy to FINMA).

The management of UK private clients (natural persons and private investment structures) who exceed the threshold of GBP 2 million requires a written declaration from the client in a separate document with appropriate risk disclosure. Furthermore, there is a disclosure obligation towards all clients, where, among other things, reference must be made to the lack of a UK licence and the lack of participation in the UK compensation scheme for financial services.

Temporary support of clients on site in the United Kingdom is possible without a licence as long as no permanent establishment is created in the United Kingdom (in accordance with recognised tax law principles).

Swiss financial institutions that make use of the agreement must report annually to the FCA (with a copy to FINMA) on their relevant activities (number of clients, type of service, total turnover, client complaints, etc.).

For British providers of financial services, cross-border business activities in Switzerland are already largely possible today, especially for professional clients. This is explicitly stated in the agreement. In addition, British client advisors can, under certain conditions, provide temporary local support to wealthy private clients in Switzerland without having to register in Switzerland.

Asset management - Advertising and offering

The existing national regulations for the advertising and offering of collective investment schemes, the delegation of investment decisions and portfolio risk management are confirmed.

Insurance companies

The agreement allows UK insurance companies to operate across borders and Swiss insurance companies to provide cross-border insurance services to large corporate clients. The provision of accident, health and most types of liability insurance in Switzerland as well as monopoly insurance (e.g. buildings insurance) of all kinds for professional policyholders are not covered.

Stock exchanges and other financial market infrastructures

The agreement facilitates compliance with certain obligations in cross-border transactions and confirms the mutual recognition of the general legal and supervisory framework for trading venues.

Sustainable Finance

Switzerland and the United Kingdom will also cooperate more closely in the area of sustainable finance in the future and develop a programme on the possibility of mutual recognition of corresponding rules and standards.

Next steps and need for action

The signed agreement must be approved by the parliaments of both countries before it can enter into force. The Federal Council will prepare a dispatch to be submitted to Parliament before the end of this year. The exact date of entry into force is not yet known.

However, Swiss financial service providers with links to the UK can already familiarise themselves with the new possibilities under the agreement and incorporate the resulting opportunities into their strategic considerations.

Contacts |