-

Audit Industry, Services, Institutions

More security, more trust: Audit services for national and international business clients

-

Audit Financial Services

More security, more trust: Audit services for banks and other financial companies

-

Corporate Tax

National and international tax consulting and planning

-

Individual Tax

Individual Tax

-

Indirect Tax/VAT

Our services in the area of value-added tax

-

Transfer Pricing

Our transfer pricing services.

-

M&A Tax

Advice throughout the transaction and deal cycle

-

Tax Financial Services

Our tax services for financial service providers.

-

Financial Services

Consultancy services that generate real added value for financial service providers.

-

Advisory IT & Digitalisation

Generating security with IT.

-

Forensic Services

Nowadays, the investigation of criminal offences in companies increasingly involves digital data and entire IT systems.

-

Regulatory & Compliance Financial Services

Advisory services in financial market law and sustainable finance.

-

Transaction Services / Mergers & Acquisitions

Successfully handling transactions with good advice.

-

Legal Services

Experts in commercial law.

-

Trust Services

We are there for you.

-

Business Risk Services

Sustainable growth for your company.

-

Abacus

Grant Thornton Switzerland Liechtenstein has been an official sales partner of Abacus Business Software since 2020.

-

Accounting Services

We keep accounts for you.

-

Payroll Services

Leave your payroll accounting to us.

-

Real Estate Management

Leave the management of your real estate to us.

-

Apprentices

Career with an apprenticeship?!

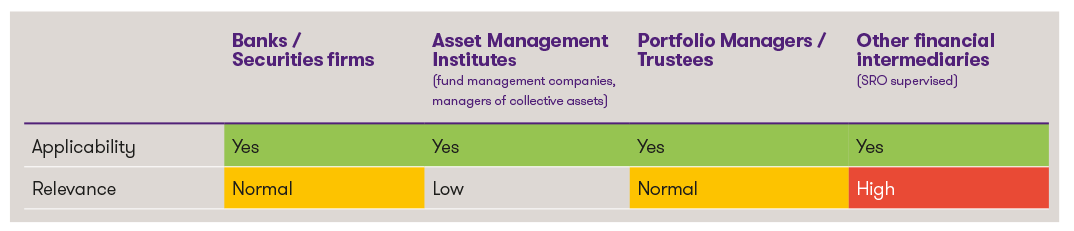

Classification1

1 This is a highly simplified presentation intended to enable a quick initial categorisation of the topic. Each institution should determine the relevance and the specific need for action individually and specifically.

Transparency register: New federal law on the transparency of legal entities and the identification of beneficial owners

- Aim and purpose: The transparency register is intended to enable the identification and tracking of the beneficial owners of legal entities. This measure serves to reduce the anonymity that could be used in some structures to conceal illegal activities and to increase transparency.

- Obligations for legal entities: Legal entities must identify the natural persons who ultimately exercise control over or are involved in the legal entity. These must be clearly identified. The information on the beneficial owners must be regularly reviewed and updated. This continuous review ensures that the data in the transparency register is always up-to-date and correct. The data obtained must be documented and reported to the transparency register. This includes information such as the full name, date of birth, nationality and residential address of the beneficial owner. In addition, information on the type of participation or control exercised by the beneficial owners must also be documented.

- Management and administration of the transparency register: The transparency register is managed centrally by the Federal Office of Justice (FOJ). This centralised administration enables the coherent and standardised handling of data. The information stored in the transparency register is to be made available to the criminal prosecution authorities, tax authorities and financial market supervisory authorities. Access to the register is strictly regulated and only takes place if there is a legitimate interest in fulfilling legal tasks.

- Sanctions and enforcement: Legal entities that do not fulfil their reporting obligations or provide false information will be subject to sanctions (fines or other administrative measures). Mechanisms will be set up to monitor compliance with the reporting obligations. This includes regular checks and audits by the competent authorities.

Introduction of due diligence obligations for lawyers and advisors

The partial revision of the Anti-Money Laundering Act (AMLA) provides the introduction of specific due diligence obligations for advisors who are active in certain areas (areas susceptible to money laundering and terrorist financing). In the case of real estate transactions, this includes legal advice relating to the acquisition, sale or brokerage of real estate. In the case of company formations and conversions, the regulations apply to advice relating to the formation, conversion or sale of companies (domiciliary companies and operating companies). Lawyers and advisors in this area must fulfil certain AML due diligence obligations in future:

- Affiliation to a self-regulatory organisation (SRO): Lawyers and advisors who work in the areas mentioned must join an SRO. The SRO monitors compliance with the regulatory requirements (usually through auditing companies).

- Due diligence obligations in detail:

- Identification and verification of clients: Lawyers and advisors must identify their clients and establish the beneficial owners (including controlling persons).

- Documentation of business relationships: Lawyers and advisors must keep complete and comprehensible documentation of business relationships. The documents must be kept for a specified period and made available to the competent authorities on request.

- Duty to report: If a lawyer or advisor suspects money laundering or terrorist financing, he is obliged to report this to the Money Laundering Reporting Office Switzerland (MROS).

- Identification and verification of clients: Lawyers and advisors must identify their clients and establish the beneficial owners (including controlling persons).

Further measures

- Adjustment of the threshold for cash payments: The threshold for cash payments in the real estate sector is to be reduced to CHF 0 (previously CHF 100’000). In the area of precious metals and gemstone trading, the threshold value should now be CHF 15’000 (previously also CHF 100’000). There will be exceptions for trade in finished products (such as jewelry) and thus for the retail trade.

- Prevention of violations of sanctions/embargoes: As part of the organisational measures, financial intermediaries are to be obliged to take measures (i.e. identify, limit and monitor sanction risks) that are necessary to prevent violations of measures under the Embargo Act (EmbA) (supplement to Art. 8 AMLA).

- Standardisation of reports to MROS: To improve the efficiency and uniformity of reports, a standard format will be defined for reports to the Money Laundering Reporting Office Switzerland (MROS).

- Regulation of the exchange of information: The exchange of information between the Swiss Financial Market Supervisory Authority (FINMA) and the supervisory organisations (SO) will be clearly regulated in order to ensure improved cooperation and coordination.

Conclusion and outlook

Through the measures described above, a more robust and effective structure for preventing and combating money laundering is to be created. This should fulfil both national requirements and international obligations (in particular FATF/GAFI and Global Forum). With the submission of the legislative proposal to the Federal Assembly, the entry into force of the new provisions is planned for 2026 at the earliest. Financial service providers should closely monitor further developments and, depending on their business model, size and strategy, identify the specific impact, evaluate the need for adjustments and initiate the necessary implementation measures at an early stage.