-

Audit Industry, Services, Institutions

More security, more trust: Audit services for national and international business clients

-

Audit Financial Services

More security, more trust: Audit services for banks and other financial companies

-

Corporate Tax

National and international tax consulting and planning

-

Individual Tax

Individual Tax

-

Indirect Tax/VAT

Our services in the area of value-added tax

-

Transfer Pricing

Our transfer pricing services.

-

M&A Tax

Advice throughout the transaction and deal cycle

-

Tax Financial Services

Our tax services for financial service providers.

-

Financial Services

Consultancy services that generate real added value for financial service providers.

-

Advisory IT & Digitalisation

Generating security with IT.

-

Forensic Services

Nowadays, the investigation of criminal offences in companies increasingly involves digital data and entire IT systems.

-

Regulatory & Compliance Financial Services

Advisory services in financial market law and sustainable finance.

-

Transaction Services / Mergers & Acquisitions

Successfully handling transactions with good advice.

-

Legal Services

Experts in commercial law.

-

Trust Services

We are there for you.

-

Business Risk Services

Sustainable growth for your company.

-

Abacus

Grant Thornton Switzerland Liechtenstein has been an official sales partner of Abacus Business Software since 2020.

-

Accounting Services

We keep accounts for you.

-

Payroll Services

Leave your payroll accounting to us.

-

Real Estate Management

Leave the management of your real estate to us.

-

Apprentices

Career with an apprenticeship?!

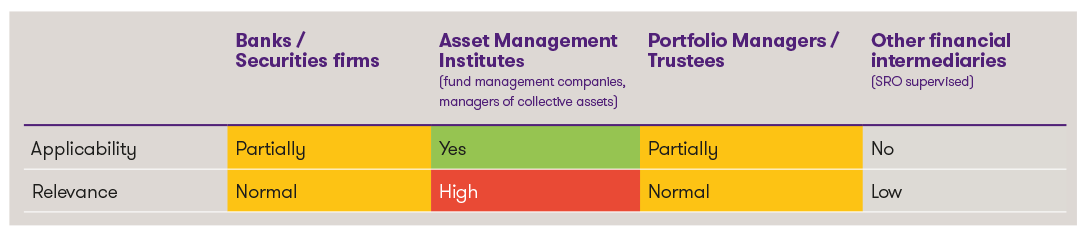

Classification of the amendments1

1 This is a highly simplified presentation intended to enable a quick initial categorisation of the topic. Each institution should determine the relevance and the specific need for action individually and specifically.

Selected changes to the CISO that are not directly related to the new L-QIF, but affect the asset management industry as a whole, are highlighted below. For comprehensive information on the L-QIF, please refer to the corresponding newsletter "The new L-QIF at a glance".

Compliance with the definition of collective investment schemes

The CISO now clearly states that fund management companies, SICAVs, SICAFs and SICAFs, as fund or licence holders, are responsible for constant compliance with the definition of a collective investment scheme set out in Art. 7 CISA (Art. 5 para. 6 CISO). These characteristics include, in particular, third-party management, collectivity and equal treatment of investors. This means that FINMA now has a clear legal basis for using its supervisory instruments in the event of violations. However, these definitions still do not apply without restriction: for example, in the case of single-investor funds, investors may be allowed to influence investment decisions and the principle of equal treatment of investors may be waived by means of different asset classes, provided there are objective criteria for differentiation.

Rules of conduct for foreign collective investment schemes

Art. 20 et seq. CISA impose specific duties of conduct on CISA institutions, such as duties of loyalty, due diligence and information. With the reformulation of Art. 20 ff. CISA as part of the introduction of the FinSA, the opinion developed in some cases that the rules of conduct for foreign collective investment schemes did not apply. With the amendment of the CISO in Art. 31 to 34, the legislator clarifies that this is not the case and that the rules of conduct also apply to managers and representatives of foreign collective investment schemes.

Best Execution

The provisions of the FinSA on best execution do not generally apply to the management of collective investment schemes, as these are mostly institutional clients and the rules of conduct are not applicable. As a correction, Art. 22 contained in the old CISA was therefore included in the CISO (now Art. 31a CISO), whereby the wording of the "new" provision is based on Art. 18 FinSA. The Federal Council emphasises that a careful selection of counterparties also implies their regular review. For implementation, Art. 21 para. 1 and 4 FinSO must be applied analogously, i.e. the criteria for the execution of transactions and the choice of execution venue must be defined and reviewed at least annually. For managers of collective investment schemes that conduct their trading exclusively through prudentially supervised institutions, the implementation of these obligations is likely to be simplified in practice. However, it does not release the institutions from the responsibility and supervision of these institutions.

Debitable incidental costs

The list of incidental costs that may or may not be charged to the fund or sub-fund assets has been supplemented and specified (Art. 37 para. 2 ff. CISO). For example, the costs of hedging transactions are also included in the costs for the purchase and sale of investments and may be charged to the fund assets. Furthermore, this is an exhaustive catalogue of chargeable incidental costs. The requests made in the consultation procedure to provide an exemplary list instead were rejected.

Active investment breaches

The CISO now contains specific requirements for dealing with active investment breaches (Art. 67 para. 2bis CISO). These are provisions that were previously set out in FINMA Supervisory Notice 40 (2012). In the event of active investment breaches, the investments must be immediately reduced to the permitted level. In the case of passive investment breaches, there is no change and a reduction must be ensured within a reasonable period of time.

If an active investment breach occurs, it must be clarified promptly whether there has been any investor detriment. If there has been damage and the fund management company or the SICAV has not compensated the investors, they must at least be informed. The investor can then decide to sue for damages or draw other consequences from the incident. Therefore, the active investment breach must be published quickly. In addition, active investment breaches without indemnification of the investors must be reported to the audit firm without delay and published in the annual report.

Exchange Traded Funds

The requirements on the asset classes of exchange traded funds (ETFs) originally regulated selectively in Art. 40 para. 5 CISO based on international standards have been expanded and are now regulated in Art. 106 CISO (domestic ETFs) and Art. 127b CISO (foreign ETFs). There is now a legal definition together with provisions on the designation and documentation of a collective investment scheme as an ETF and on the offering of foreign ETFs in Switzerland. The units or unit classes of domestic ETFs must be permanently listed on an authorised Swiss stock exchange. Foreign ETFs are subject to the same requirement if their units or unit classes are offered to non-qualified investors in Switzerland.

Segregation of assets ("side pockets")

The concept of "side pockets" has been codified by enshrining the possibility of segregating individual illiquid investments from a collective investment scheme in the CISO (Art. 110 a CISO). The possibility of creating side pockets must be provided for in the fund contract or investment regulations and requires the prior approval of FINMA.

Liquidity risks: Obligations for SICAVs and fund management companies

Art. 10 and 11 of the FINIO-FINMA already explicitly stipulates the obligation for managers of collective assets to ensure appropriate liquidity risk management. In accordance with international standards, the new Art. 78a CISA in conjunction with the new Art. 108a CISO now also requires SICAVs and fund management companies to ensure that the liquidity of the collective investment scheme is appropriate to the investments, investment policy, risk diversification, investor base and redemption frequency.

To this end, various key principles relating to liquidity management in the management of collective investment schemes have also been included in the CISO. In particular, the liquidity profile of the investments must match the redemption frequencies and the group of investors, which in turn requires the necessary information to be available. With regard to the latter, the Federal Council states in its dispatch that the individual investors do not have to be known by name, but the necessary information must be available in order to anticipate investor behaviour and estimate future liquidity requirements (e.g. qualification of investors, redemption conditions, relative size of investments, etc.).

In order to strengthen the proper monitoring and management of the liquidity of open-ended collective investment schemes, the fund management company or the SICAV must conduct regular stress tests (Art. 108a para. 3 CISO). Among other things, they are intended to help ensure that liquidity risks can be managed appropriately in the best interests of investors. The stress tests are carried out and reviewed by persons who are sufficiently independent of the portfolio management function. Stress tests may be waived in accordance with the proportionality rule if the net fund assets are less than CHF 25 million.

Finally, the fund management company or SICAV must now draw up a crisis plan for each collective investment scheme and define specific measures, processes and responsibilities in it (Art. 108a para. 4 CISO). The crisis plan must be reviewed regularly and adjusted if necessary.

Conclusion and outlook

In addition to the changes resulting from the introduction of the L-QIF, the other amendments to the CISO also have a significant impact on supervised institutions. In some cases, the significance of the changes is even greater, as they apply to all CISA institutions, i.e. even those that do not intend to manage L-QIFs. In addition, asset managers may also be directly affected by the changes in accordance with Art. 17 FinIA if they manage collective investment schemes below the de minimis threshold. A transitional period of two years applies to existing institutions with regard to the new regulations on ETFs and liquidity risks, while the other changes apply with immediate effect. Affected institutions should carefully analyse the changes and - where applicable - implement them promptly in their internal directives, processes and controls and, if necessary, amend the documentation for collective investment schemes. Institutions should pay particular attention to the changes in the area of liquidity management.