-

Audit Industry, Services, Institutions

More security, more trust: Audit services for national and international business clients

-

Audit Financial Services

More security, more trust: Audit services for banks and other financial companies

-

Corporate Tax

National and international tax consulting and planning

-

Individual Tax

Individual Tax

-

Indirect Tax/VAT

Our services in the area of value-added tax

-

Transfer Pricing

Our transfer pricing services.

-

M&A Tax

Advice throughout the transaction and deal cycle

-

Tax Financial Services

Our tax services for financial service providers.

-

Advisory IT & Digitalisation

Generating security with IT.

-

Forensic Services

Nowadays, the investigation of criminal offences in companies increasingly involves digital data and entire IT systems.

-

Regulatory & Compliance Financial Services

Advisory services in financial market law and sustainable finance.

-

Mergers & Acquisitions / Transaction Services

Successfully handling transactions with good advice.

-

Legal Services

Experts in commercial law.

-

Trust Services

We are there for you.

-

Business Risk Services

Sustainable growth for your company.

-

IFRS Services

Die Rechnungslegung nach den International Financial Reporting Standards (IFRS) und die Finanzberichterstattung stehen ständig vor neuen Herausforderungen durch Gesetzgeber, Regulierungsbehörden und Gremien. Einige IFRS-Rechnungslegungsthemen sind so komplex, dass sie generell schwer zu handhaben sind.

-

Abacus

Grant Thornton Switzerland Liechtenstein has been an official sales partner of Abacus Business Software since 2020.

-

Accounting Services

We keep accounts for you.

-

Payroll Services

Leave your payroll accounting to us.

-

Real Estate Management

Leave the management of your real estate to us.

-

Apprentices

Career with an apprenticeship?!

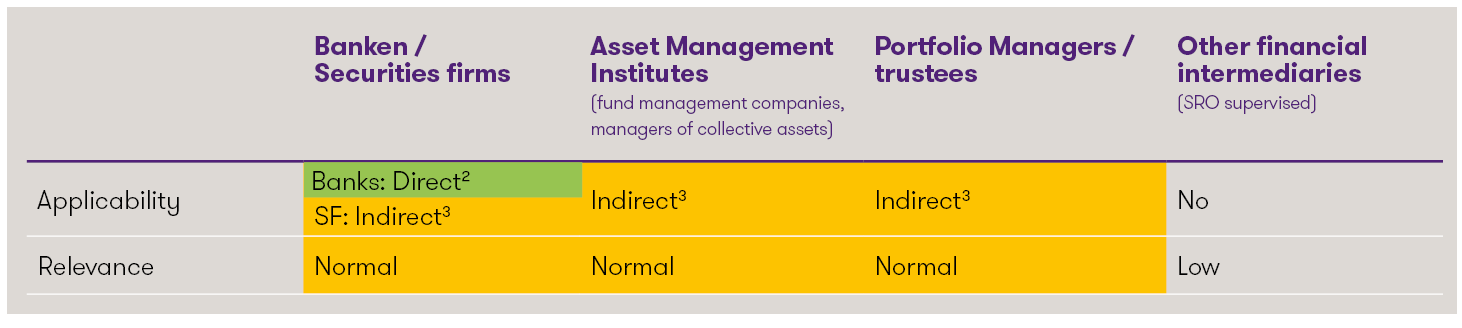

Classification 1

1 This is a highly simplified presentation intended to enable a quick initial categorisation of the topic. Each institution should determine the relevance and the specific need for action individually and specifically.

2 Provided the bank in question is a member institution of the Swiss Bankers Association (SBA).

3 If the financial institution in question is not a member institution of the Swiss Bankers Association (SBA) or has not voluntarily submitted to the guidelines.

Content of guidelines

Put simply, the new guidelines extend the obligations of the FinSA to include the area of ESG. In concrete terms, this means that clients in asset management and investment advice must be actively asked about their ESG preferences. Clients are categorised according to their expressed ESG preferences, e.g. very interested, interested or neutral/not interested. If a customer is neutral in ESG terms, ESG aspects no longer need to be considered in the context of suitability. However, if a client has expressed ESG preferences, these preferences must be taken into account when providing the service. If, in such a case, an institution does not offer ESG-compliant financial services, it should refrain from providing services.

Choosing a suitable investment solution that has the sustainability features favoured by clients can be challenging in practice. The investment solutions offered must include these features, otherwise it is not possible to verify whether the specific sustainability goals have been achieved.

The applicability of the other FinSA rules of conduct is based on the level of protection afforded to clients. Professional clients within the meaning of FinSA can waive certain of these obligations, while the provisions are fully applicable to private clients.

Since 1 January 2024, the topic of ESG must then be appropriately integrated into the training and further education of the client advisors of the institutions concerned.

Significance for other financial service providers

The guidelines are not binding for financial service providers that are not members of the SBA (e.g. asset managers) unless they have voluntarily submitted to them. This also applies to banks that are not members of the SBA. At present, there is also no explicit legal obligation (yet), e.g. under FinSA, to observe the ESG preferences of clients at the point of sale. However, despite the lack of clear regulations, asset managers must take ESG into account when providing investment advice or asset management:

- Supervisory law (FinSA)

If ESG preferences are collected voluntarily by the asset manager and are not taken into account when providing the investment advice or portfolio management service, the financial service provider risks failing to comply with suitability by selecting an investment solution that is unsuitable for the client. The assessment of suitability under the FinSA is therefore not limited to financial investment objectives, but also includes the ESG preferences expressed by the client (in the sense of an investment restriction on the part of the client).

- Civil law (law governing mandate agreements)

In addition to regulatory requirements, asset management and investment advice must always comply with civil law, in particular the law governing mandate agreements. Asset managers must already now understand the (ESG) risks of the investment solutions recommended to clients and inform clients of the associated risks. If, for example, an asset management mandate involves investing in shares of companies in a sector with high CO2 emissions, the effects of existing or possible future regulation of this sector must be anticipated and, if necessary, communicated to the client.

- EU law (MiFID II - delegated acts)

In the EU, the MiFID II directive and its delegated acts, respectively, have been supplemented by specific ESG behavioural obligations at the point of sale. For example, the suitability test was expanded to include consideration of sustainability factors and an obligation to take ESG preferences into account was introduced. Depending on the customer structure and type of service provision and marketing, Swiss institutions may indirectly fall within the scope of the European requirements.

Need for action for asset managers?

From a purely legal and regulatory perspective, there are certain obligations in connection with the collection of ESG preferences at the point of sale, as already explained. However, according to the view expressed here, asset managers are not (yet) obliged to actively enquire about ESG preferences. However, should the provisions of the guidelines develop into an objectively recognised standard of due diligence in the future, non-compliance with them could lead to civil law risks. Depending on the business model and client structure of the institution, non-compliance would also increase cross-border risks.

FINMA has made the following statement in the context of greenwashing prevention: "Furthermore, FINMA highlights to financial service providers who offer sustainability-related financial products that the advisory process (at the point of sale) involves greenwashing risks. These risks should be limited by financial service providers, particularly in view of their potential civil liability."

If one adds a “market perspective” to the purely regulatory view, the “must”, then asset managers cannot avoid dealing with the potential impact of the new guidelines. After all, the majority of banks in Switzerland have been recording the ESG preferences of their (new) clients since the beginning of the year and, at least for this segment, it does not seem inappropriate to speak of a “new normal”. The risk of falling behind in such a market environment should be addressed.

To summarise, we note that the implementation of the guidelines may be “optional” from a regulatory perspective for other financial service providers, in particular asset managers, but their potential influence on the market and, thus, on the asset manager's business model must be taken into account when defining the strategy.